CPI Report for April 2025

The next Consumer Price Index (CPI) report will be released on Tuesday, May 13, 2025, at 8:30 a.m. ET. This report will cover inflation data for April 2025 .

The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.

The March 2025 CPI report reflected a notable easing of inflation, driven by falling energy and travel costs and moderate food price increases. Core inflation also slowed, suggesting weaker underlying price pressures. The March report signaled a significant cooling in inflation, with both headline and core measures easing and the monthly CPI posting its first decline in nearly five years. The March decline in energy prices was driven by falling oil prices due to economic concerns, a sharp drop in gasoline prices, reduced seasonal demand, and high natural gas production and inventories. Core CPI rose just 0.1% month-over-month in March, down from a 0.2% increase in February. This was the smallest monthly gain in nine months and came in well below consensus forecasts.

Economists expect the April 2025 Consumer Price Index (CPI) report to show the first signs of inflationary effects from President Trump’s tariffs.

The consensus forecast is:

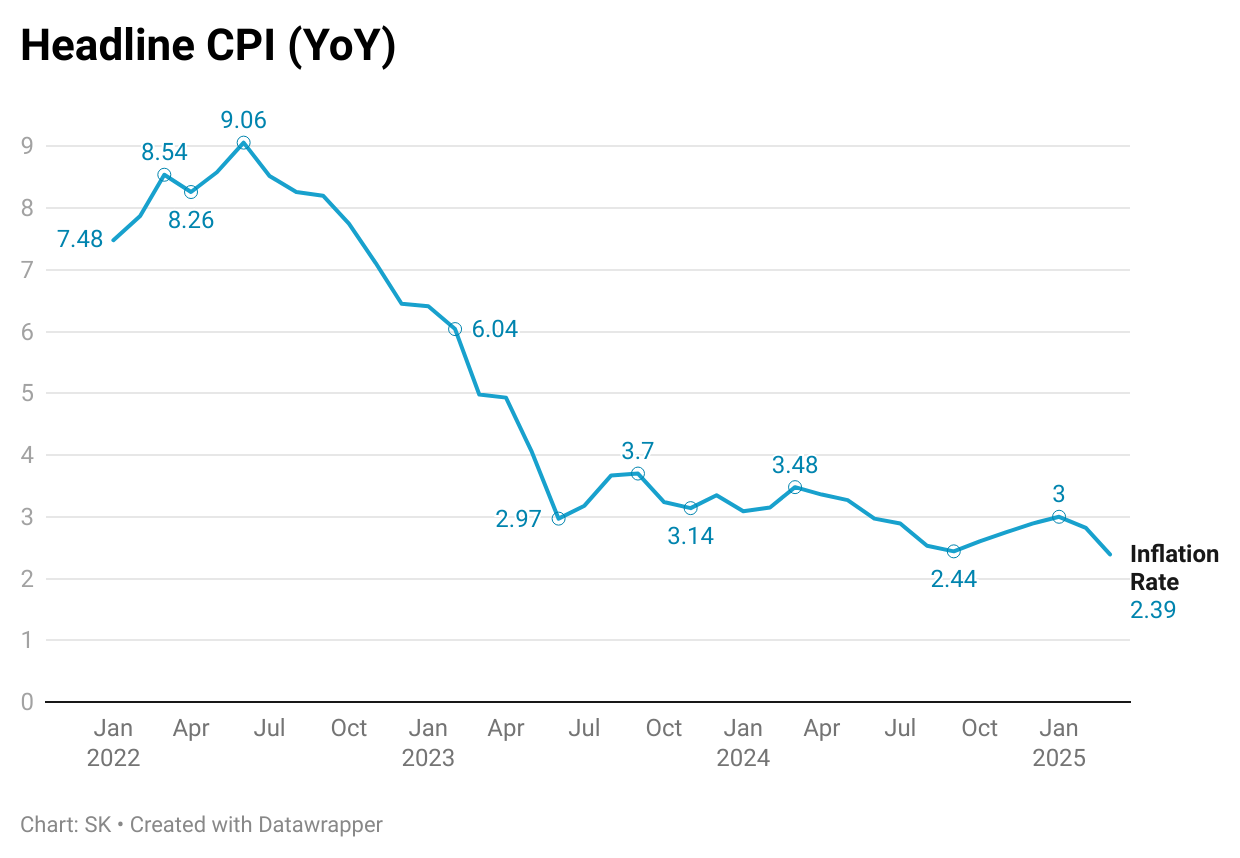

Headline CPI (year-over-year): Expected to remain at 2.4%, unchanged from March.

Headline CPI (month-over-month): Projected to rise by 0.3%, reversing the 0.1% decline seen in March.

Core CPI (year-over-year, excludes food and energy): Anticipated to be steady at 2.8%, the same as the previous month and still at a four-year low.

Core CPI (month-over-month): Expected to increase by 0.3%, up from the 0.1% gain in March.

Economists note that the full inflationary impact of tariffs may take three to six months to materialize, but April’s report is likely to show the initial effects.

Why does CPI matter?

CPI data is crucial for investors for several reasons:

Inflation indicator: The CPI serves as a key measure of inflation, allowing investors to gauge inflationary trends and their potential impact on the economy.

Monetary policy insights: CPI data influences Federal Reserve decisions on interest rates, which in turn affect corporate profitability and stock market performance.

If you found this post helpful, we encourage you to subscribe. Our content delivers high-quality macroeconomic and financial insights and education for anyone looking to enhance their understanding of the financial markets and the economy.