Daily Newsletter 11/18/25

Today, U.S. financial markets are experiencing a downturn, with major indices pulling back amid a cautious investor mood. Yesterday, the markets continued a recent trend of declines following earlier strong gains, reflecting profit-taking and uncertainty ahead of key earnings reports. Last week, the markets had rallied steadily, driven by optimism around AI developments and strong corporate earnings, but recent concerns about valuations and mixed signals from economic data have tempered confidence. Overall, investors remain watchful, balancing the positives of robust fundamentals against rising caution in the near term. Market participants are closely monitoring upcoming earnings and economic indicators to gauge future directions.

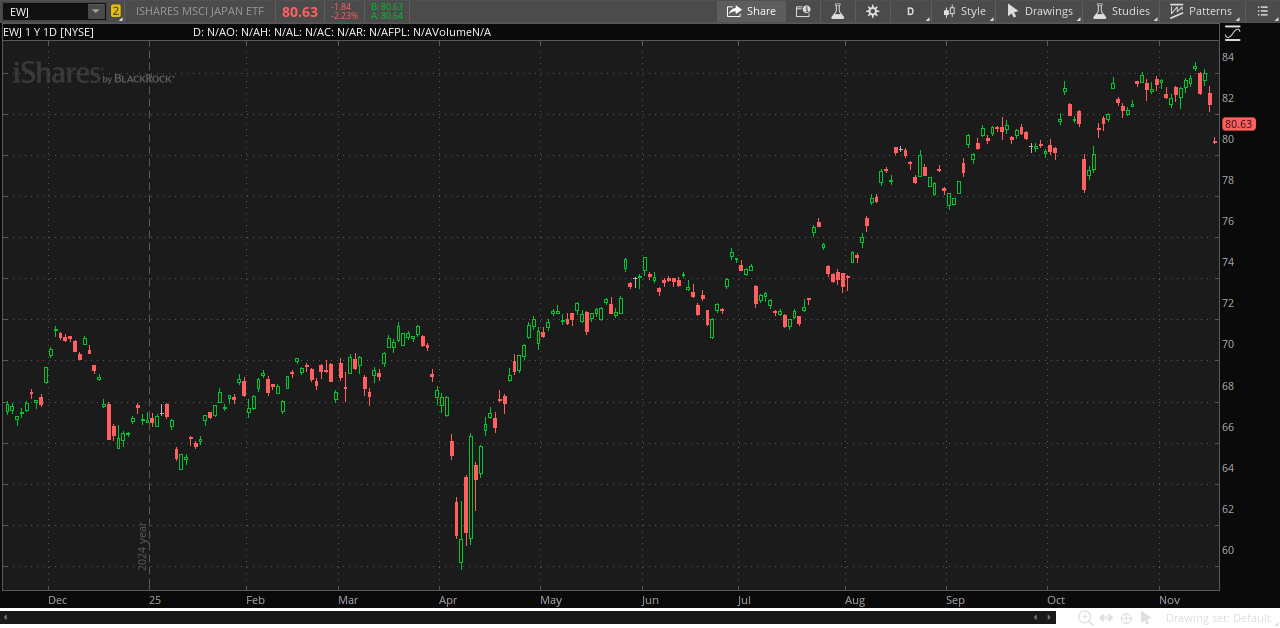

Rising China-Japan Tensions over Taiwan Escalate Market Uncertainty

Tensions between China and Japan have escalated recently, largely due to provocative remarks by Japan’s Prime Minister regarding Taiwan and Japan’s defense policy shifts. China has responded strongly, condemning these moves as violations of its sovereignty and a threat to regional stability. The political tensions have also impacted stock sentiments in the region, contributing further to global market caution and declines. Both sides remain entrenched in their positions, and these geopolitical tensions add to the market uncertainties today.

We are currently positioning our trades predominantly through sovereign ETFs, specifically focusing on EWJ and YANG, to effectively navigate the evolving market dynamics influenced by recent geopolitical developments. Additionally, we are maintaining a close watch on select individual stocks that experienced notable declines followed by partial recoveries, as these may present attractive opportunities. We believe there remain several potential entry points worth considering as market conditions continue to develop, and we remain prepared to act prudently based on further signals.

Earnings

We are closely monitoring upcoming earnings releases and actively developing option strategies that primarily focus on managing volatility before, during, and after the announcement periods. Our approach aims to capitalize on the heightened market movements typically associated with earnings events while carefully controlling risk. As always, these strategic option trades will be communicated promptly to our paid subscribers through our chat platform to ensure timely access to actionable insights.

OUR TRADES

We share our short-term trades within the Tactical Portfolio exclusively with our paid subscribers, providing complete transparency. This includes detailed information on our entry timing and pricing. Exits are communicated promptly through chat to ensure timely updates. Our strategies often incorporate complex option structures to capitalize on short-term market movements, reflecting a sophisticated approach to tactical trading.