Daily Newsletter 3/12/25

Good morning.

CPI

The next Consumer Price Index (CPI) data for February 2025 is scheduled to be released today, Wednesday, March 12, 2025, at 8:30 a.m. ET. This release will provide crucial information on inflation trends in the United States for the previous month.

Key points to anticipate:

Analysts predict the annual headline inflation rate for February to be 2.9%, slightly lower than January's 3% increase.

Month-over-month, prices are forecasted to rise by 0.3%, a decrease from January's 0.5% uptick.

Core CPI, excluding food and energy, is expected to show a 3.2% rise over the past year, just below January's 3.3% growth.

The data will reflect the first full month of the Trump administration, with some economic policies yet to take effect.

Economists are closely watching this report as it may indicate whether inflation pressures have eased amid recent growth concerns.

The CPI data release is a significant economic indicator that will likely influence discussions about potential Federal Reserve interest rate adjustments in 2025. Market participants and policymakers will be analyzing this information to gauge the overall health of the U.S. economy and to inform future economic decisions. U.S. stock futures are rising ahead of the Consumer Price Index (CPI) data release. This upward trend comes after a volatile trading session on Tuesday, which saw major indices close lower due to concerns about President Trump's trade policies.

TARIFFS

President Donald Trump's 25% tariffs on all steel and aluminum imports took effect on Wednesday, March 12, 2025. This sweeping measure applies to metal imports from all countries globally, without exceptions or exemptions. The tariffs were implemented as part of Trump's strategy to reshape global trade norms in favor of U.S. manufacturing.

Key points about the new tariffs:

The aluminum duty increased from 10% to 25%.

The tariffs apply to a wide range of products, including 289 downstream product categories, potentially affecting $147.3 billion worth of consumer goods and industrial parts.

Affected items include automotive and tractor parts, metal furniture, construction materials, and various other products like stainless steel sinks, gas stoves, and horseshoes.

International reactions:

The European Union swiftly announced retaliatory measures, planning to impose tariffs on approximately €26 billion ($28 billion) worth of American goods.

Canada faced a brief threat of 50% tariffs, which was retracted after Ontario Premier Doug Ford agreed to suspend a 25% surcharge on electricity exports to certain U.S. states.

Australian Prime Minister Anthony Albanese criticized the tariffs as "entirely unjustified" but stated Australia would not impose reciprocal tariffs.

The implementation of these tariffs has intensified trade conflicts with international competitors and allies, potentially leading to increased costs for American manufacturers and consumers, and raising concerns about broader economic impacts.

EU’s retaliation

The European Union has announced retaliatory measures in response to the Trump administration's decision to impose 25% tariffs on all steel and aluminum imports. The EU's countermeasures, set to take effect on April 1, 2025, will target approximately €26 billion ($28 billion) worth of U.S. goods.

Key aspects of the EU's retaliation:

Two-phase implementation:

Phase 1 (April 1): Reinstatement of previously suspended tariffs from 2018-2020.

Phase 2 (mid-April): Introduction of new countermeasures on additional U.S. exports.

Targeted products:

Industrial goods: Steel, aluminum, textiles, home appliances, motorcycles.

Agricultural products: Soybeans, beef, poultry, bourbon, peanut butter.

Strategic targeting:

Many tariffs focus on products from Republican-held states.

Aims to create political pressure within the U.S..

Scope and justification:

Designed to match the estimated $28 billion impact of U.S. tariffs.

EU claims it "must act to protect consumers and business".

European Commission President Ursula von der Leyen emphasized that while the EU remains open to negotiations, it must take action to safeguard its interests. The EU views these tariffs as disruptive to supply chains and detrimental to both economies, potentially leading to job losses and price increases.

This escalation in trade tensions comes at a time of already strained transatlantic relations, with both sides expressing regret over the necessity of these measures.

VOLATILITY

The current value of the CBOE Volatility Index (VIX) is 26.01, reflecting a decrease of 1.85 points or 6.64% from the previous trading day.

Below is UVIX. UVIX is the 2x Long VIX Futures ETF, a leveraged exchange-traded fund that seeks to provide daily investment results corresponding to twice the performance of the Long VIX Futures Index (LONGVOL).

MORTGAGE RATES

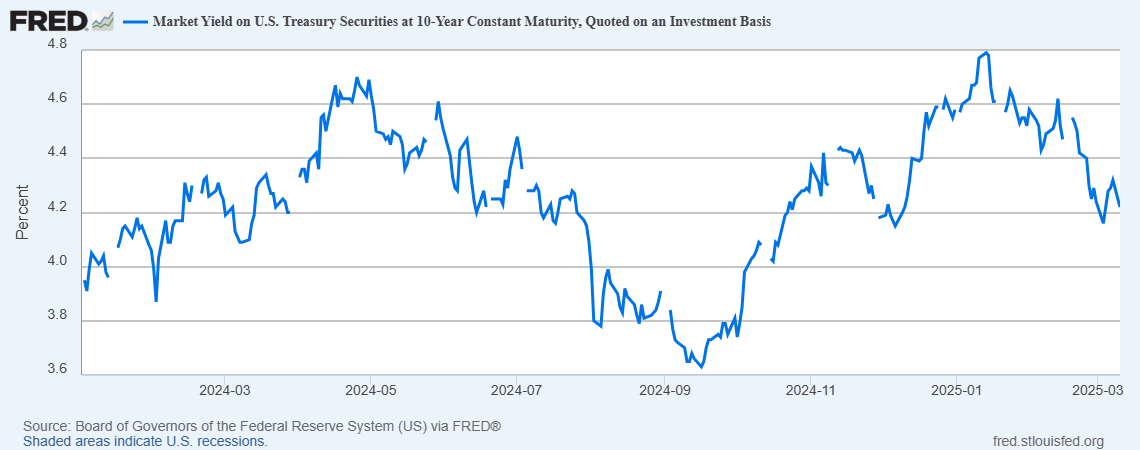

Mortgage rates have shown a slight decline in recent days, with some fluctuations observed across different loan types. Mortgage rates, particularly the 30-year fixed rate, are closely tied to the 10-year Treasury yield, typically maintaining a spread of about 1.8% to 2.35% above it, depending on market conditions. As of now, the U.S. 10-year Treasury yield is approximately 4.28%.