Daily Newsletter 3/14/25

Good morning.

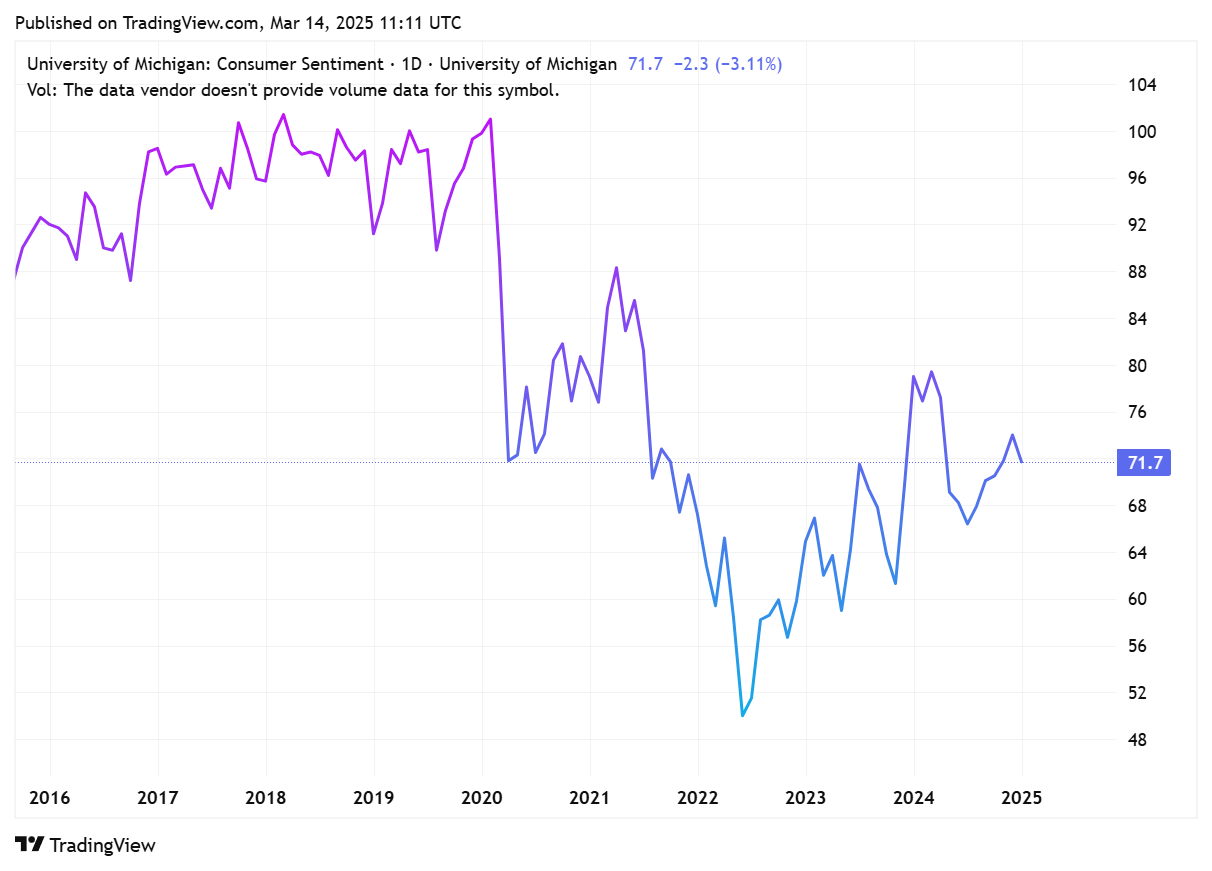

Michigan Consumer Sentiment Index

The next release of the Michigan Consumer Sentiment Index is scheduled for today, at 10:00 AM EDT. This release will provide the preliminary results for March 2025. The index is currently at a level of 64.70, which was reported for February 2025, showing a decrease from the previous month and year.

The drop in consumer confidence in February 2025 was significant and widespread, with multiple indicators showing a sharp decline:

Michigan Consumer Sentiment Index:

Fell to 64.7, the lowest level since November 2023

Decreased by 6.4 points (-9.0%) from January

Down 15.9% from a year ago, the steepest annual decline since late 2022

The recent drop is attributed to several key factors:

Economic policy uncertainty: The uncertainty surrounding new economic policies, particularly regarding tariffs and trade, is contributing to negative sentiment and making consumers' views on the economy's trajectory subject to change.

Inflation concerns: Consumers are increasingly worried about rising inflation, with year-ahead inflation expectations surging to 3.3% in January 2025, the highest since May 2024. This has led to fears of eroding purchasing power and financial instability.

Tariff developments: About 40% of consumers spontaneously mentioned tariffs in February 2025, up from 27% in January. There are growing concerns that tariff-induced price increases are imminent, prompting some consumers to consider buying now ahead of expected cost increases.

Labor market worries: More than half of consumers expect unemployment to rise in the year ahead, marking the highest share since the pandemic recession. This pessimistic outlook on the job market is further driving the decline in consumer sentiment.

Personal finance expectations: Expectations for personal finances declined almost 10% in February 2025, reflecting growing pessimism about future income and financial stability.

Declining buying conditions: There was a 19% plunge in buying conditions for durables, largely due to fears of impending price increases related to tariffs.

Long-term economic outlook: The long-run economic outlook fell by about 6% to its lowest reading since November 2023, indicating a broader pessimism about the future state of the economy.

U.S. Government shutdown

As of Friday, March 14, 2025, 7:43 AM EDT, the U.S. government shutdown has not yet been avoided, but there are signs of progress:

House action: The House passed a continuing resolution (CR) on Tuesday to extend funding through September 30, 2025, largely along party lines.

Senate developments: Senate Minority Leader Chuck Schumer announced on Thursday that he would vote to advance the stopgap funding bill, signaling potential Democratic support to avert a shutdown.

Deadline: The current funding deadline expires at midnight tonight, March 14, 2025.

Remaining challenges: The bill still needs to pass the Senate with 60 votes, requiring bipartisan support.

Democratic concerns: Senate Democrats had previously proposed a shorter 4-week CR to allow more time for budget negotiations

Yield on US junk bonds

The yield on junk bonds, also known as high-yield bonds, has increased recently due to several factors:

Widening spreads: Junk bond spreads have widened to 322 basis points, their widest level since September 18, 2024. This widening reflects increased investor concerns about economic risks and a reduced appetite for higher-risk assets.

Recession fears: Growing worries about a potential recession have led investors to demand higher yields on riskier assets like junk bonds. The expectations portion of the US consumer confidence index dropped below 80, which can be indicative of a recession ahead.

Trade war concerns: The implementation of tariffs by the Trump administration has raised fears of a global trade war, contributing to economic uncertainty and pushing junk bond yields higher.

Market volatility: The uncertain economic outlook and policy environment have led to increased market volatility, which typically results in higher yields for riskier assets like junk bonds.

Inflation expectations: Year-ahead inflation expectations have surged to 6%, up from 5.2% in January, reaching the highest level since May 2023. This has put upward pressure on bond yields across the board, including junk bonds.

Declining consumer confidence: The decline in consumer sentiment has contributed to concerns about economic growth and increased demand for higher yields on junk bonds.

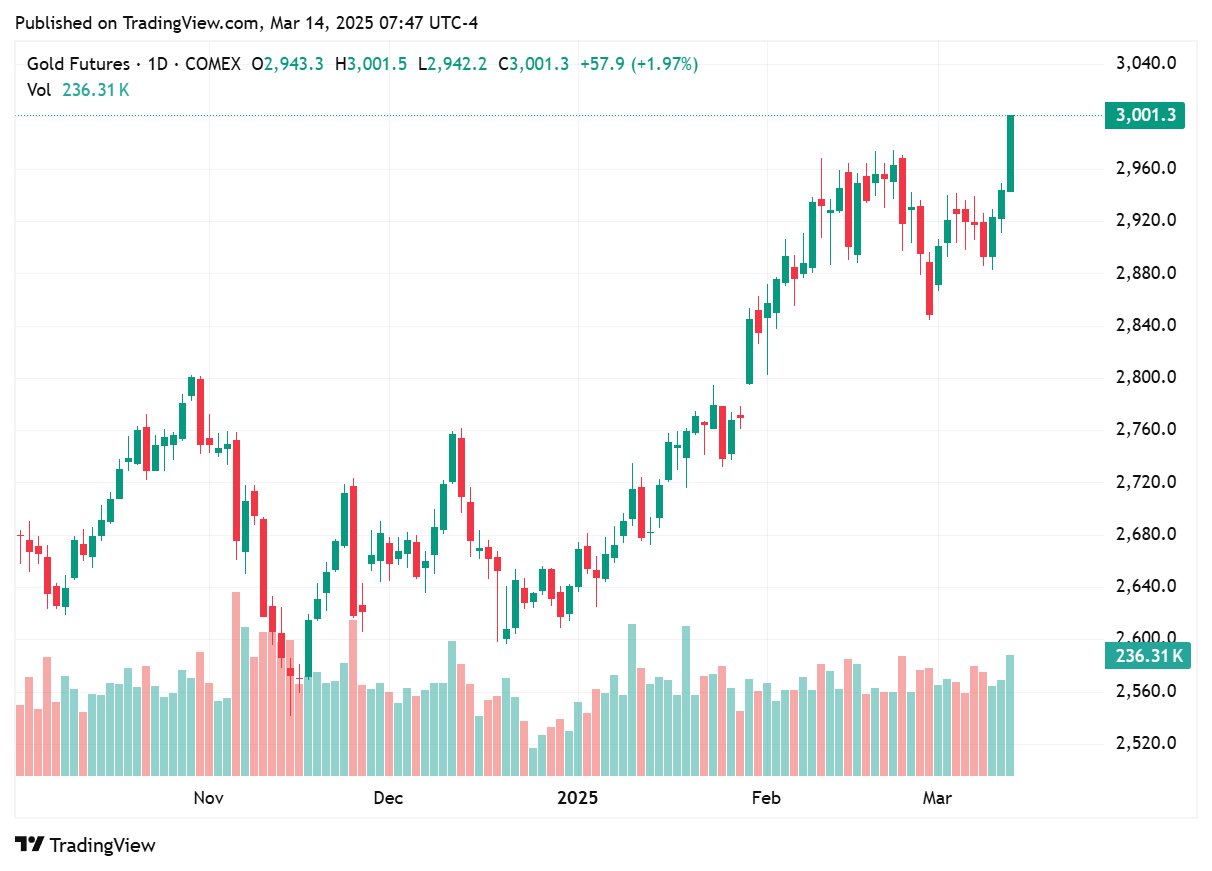

GOLD

Gold prices have surged to unprecedented levels, driven by a combination of global economic uncertainty and strategic moves by central banks. The precious metal recently topped $2,990 per ounce and is expected to continue its upward trajectory. Several key factors are contributing to this surge:

Geopolitical tensions: Ongoing conflicts and trade disputes have increased market uncertainty, boosting gold's appeal as a safe-haven asset.