Daily Newsletter 3/25/25

Good morning.

Today, we will focus on the following topics: the Johnson Redbook Index, KB Home's current status,Tesla's recent stock performance, Boeing's latest developments and the price of gold.

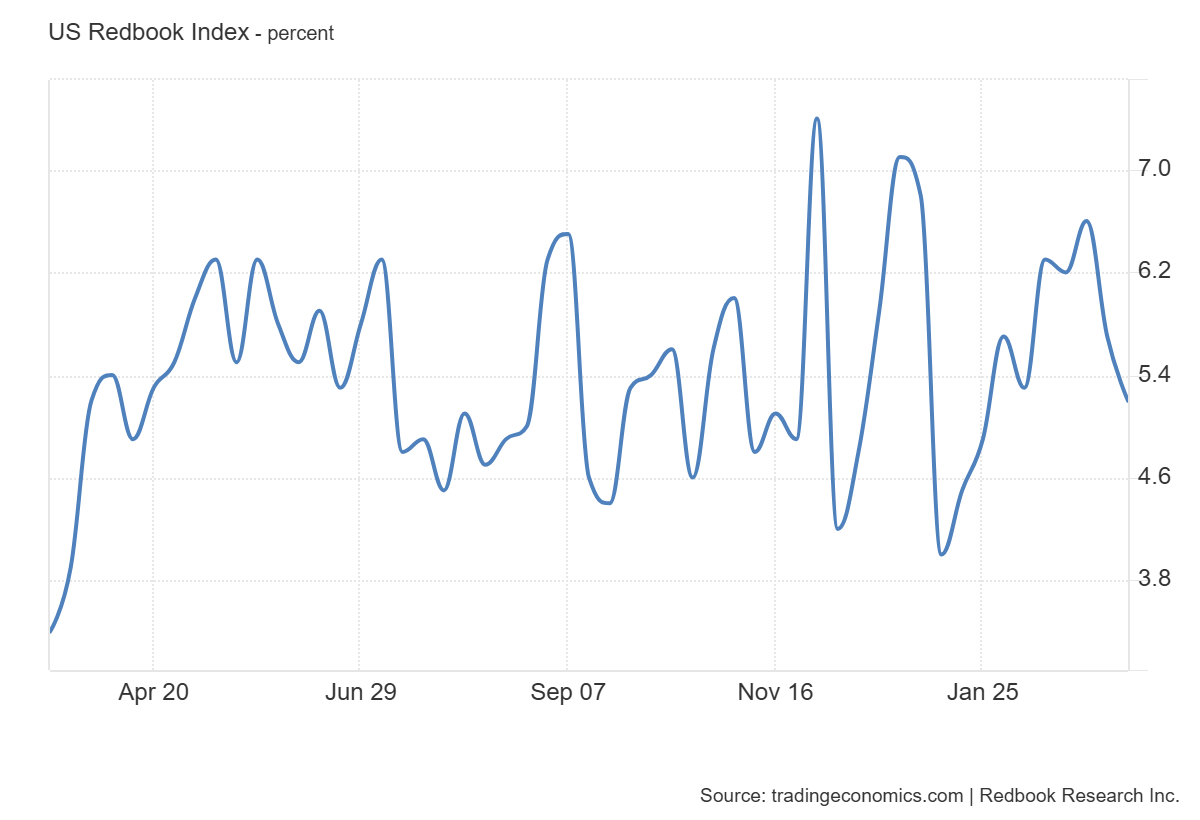

The JOHNSON REDBOOK INDEX

The Johnson Redbook Index, a key indicator of retail sales growth, is scheduled to be released today. This weekly indicator provides valuable insights into consumer spending trends and is closely watched by investors and economist.

The Johnson Redbook Index, also known as the Redbook Index, is a weekly economic indicator that measures retail sales growth in the United States. Here are the key points about this index:

Purpose: It provides advanced estimates of trends in retail sales, offering insights into consumer spending patterns and the overall health of the retail sector.

Coverage: The index tracks sales data from a sample of large retailers, including department stores, discount stores, and chain stores, representing about 9,000 stores.

Components: The index is divided into two segments:

Redbook Average: Tracks sales growth across all participating stores

Redbook Same-Store Sales Index: Focuses on sales growth within stores open for at least one year

Release Schedule: The Redbook report is typically released weekly on Tuesdays at 8:55 a.m. EDT.

Methodology: The index is sales-weighted and calculated based on year-over-year same-store sales growth. It represents over 80% of the equivalent 'official' retail sales series published by the US Department of Commerce.

Importance: As a measure of consumer spending, which is a major driver of economic growth in the US, the index is closely watched by economists, investors, and policymakers.

The Johnson Redbook Index serves as a valuable tool for assessing consumer behavior and economic trends in the retail sector, providing timely information ahead of official government releases and company reports.

KBH

KB Home (KBH) stock declined significantly in after-hours trading following the release of its fiscal first-quarter 2025 earnings report. The company's shares fell 10% after the announcement, closing at $57.37 in after-hours trading. This sharp decline was primarily due to KB Home missing analyst expectations and reducing its full-year revenue outlook.