Daily Newsletter 3/27/25

Good morning.

The markets are particularly busy today.

The Trump administration's tariff policies have injected substantial uncertainty into the market, complicating investors' ability to project growth, profitability, and global trade patterns. This unpredictability has become a major driver of market volatility as investors grapple with assessing the economic outlook and adjusting their portfolios accordingly.

Market is oversold but still not cheap. However, we foresee another drop in asset prices as investors adjust for heightened volatility and recessionary concerns. Growth stocks have more attractive valuations, but they still aren't considered cheap. The valuation bubble surrounding AI has reached its peak.

We anticipate upward momentum in the defense and financial sectors although we do not have a broadly bullish outlook for the majority of U.S. stocks. Undervalued sectors exist, but the current uncertainty complicates the situation.

Defense stocks in both Europe and Asia are currently in a bubble. For most investors investing in Europe and China has been profitable year-to-date, but there are significant risks, and with returns now stretched, some consolidation seems likely.

For detailed information on our trading setup, please upgrade your subscription to access premium content. In our premium content section, we provide access to both our long-term and short-term trading strategies.

Key Economic Developments Today

GDP: The U.S. Bureau of Economic Analysis (BEA) is scheduled to release the Gross Domestic Product (GDP) data at 8:30 AM EDT. This release will provide the third and final estimate for Q4 2024 and the annual GDP of 2024. GDP releases are crucial for understanding the current state of the economy and guiding decisions across government, business, and financial markets. Forecast: QoQ 2.4%

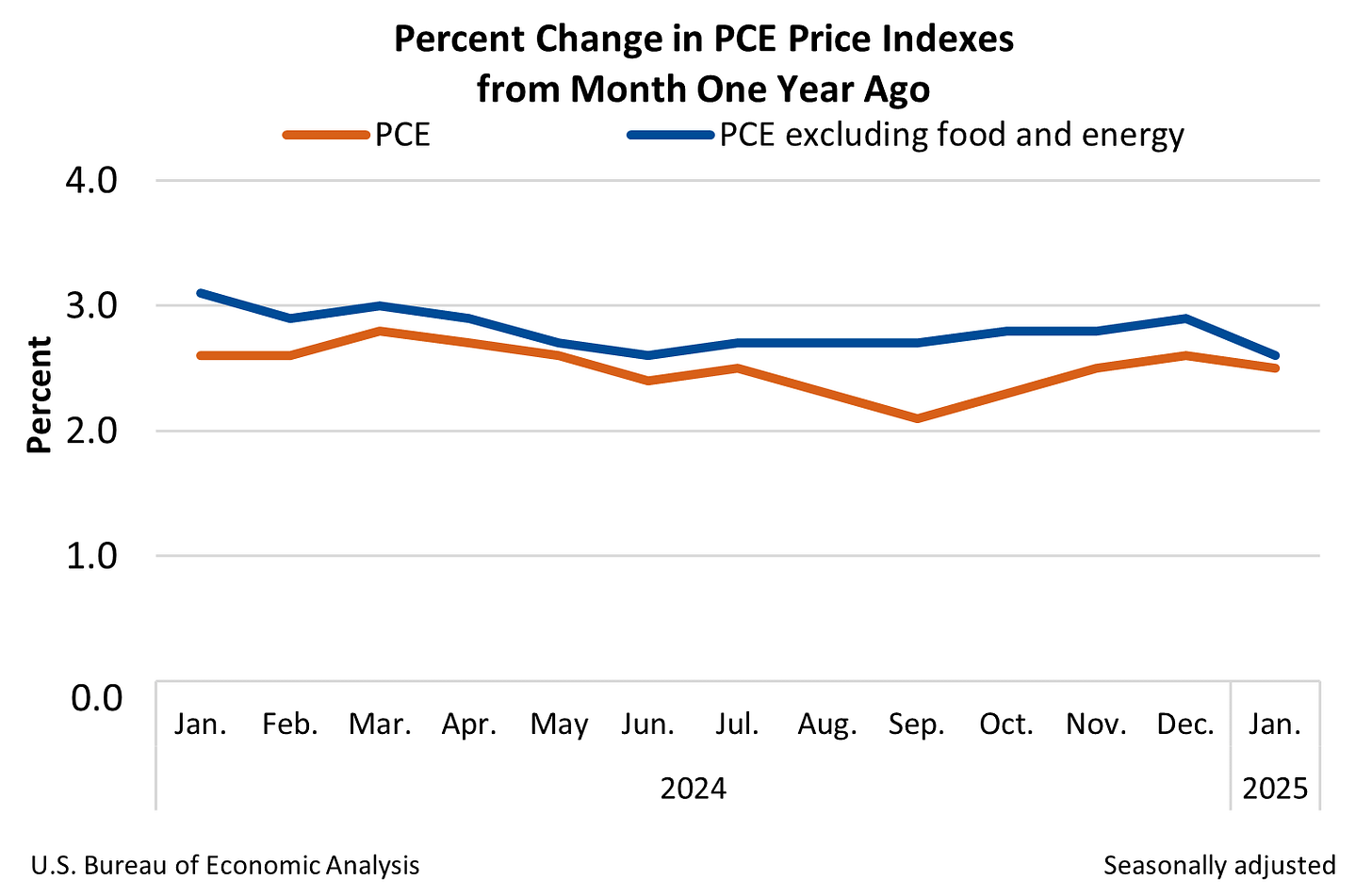

PCE Prices: The Personal Consumption Expenditures (PCE) Price Index is a measure of inflation that tracks the average change in prices of goods and services purchased by consumers in the United States. The PCE Price Index is the Federal Reserve's preferred gauge for measuring inflation.

This makes it crucial for monetary policy decisions, including interest rate adjustments. PCE data offers insights into consumer behavior and spending trends, which are critical indicators of overall economic health, as consumer spending drives about two-thirds of U.S. GDP. Forecast: QoQ 2.7%.

Jobless Claims: The next release of U.S. Initial Jobless Claims is scheduled for 8:30 AM EDT. This report will provide data for the week ending March 22, 2025. Forecast: 225,000 (Initial)

Pending Home Sales: The next release of the Pending Home Sales Index is scheduled for 10:00 AM EDT. This release will provide data for February 2025 pending home sales. Home sales serve as a key indicator of economic health, often signaling strengthening or weakening economic conditions. A significant decline in home sales can precede economic downturns. Forecast: MoM 1.5%

Tariffs: On March 26, 2025, U.S. President Donald Trump announced a 25% tariff on all imported cars and foreign-made auto parts, marking a significant escalation in the ongoing global trade war. The tariffs will take effect starting April 2, 2025, targeting vehicles and components not manufactured in the United States. Auto parts tariffs are expected to commence no later than May 3, focusing on essential components like transmissions and powertrains. These measures aim to boost domestic auto manufacturing and address trade imbalances. However, industry experts anticipate higher vehicle costs—up to $6,000 for cars produced in Canada or Mexico—and disruptions in production, potentially reducing output by 30%. While the United Auto Workers union supports the move for its job-creation potential, automakers and investors express concerns about increased costs and market instability.