Daily Newsletter 3/28/25

Good morning.

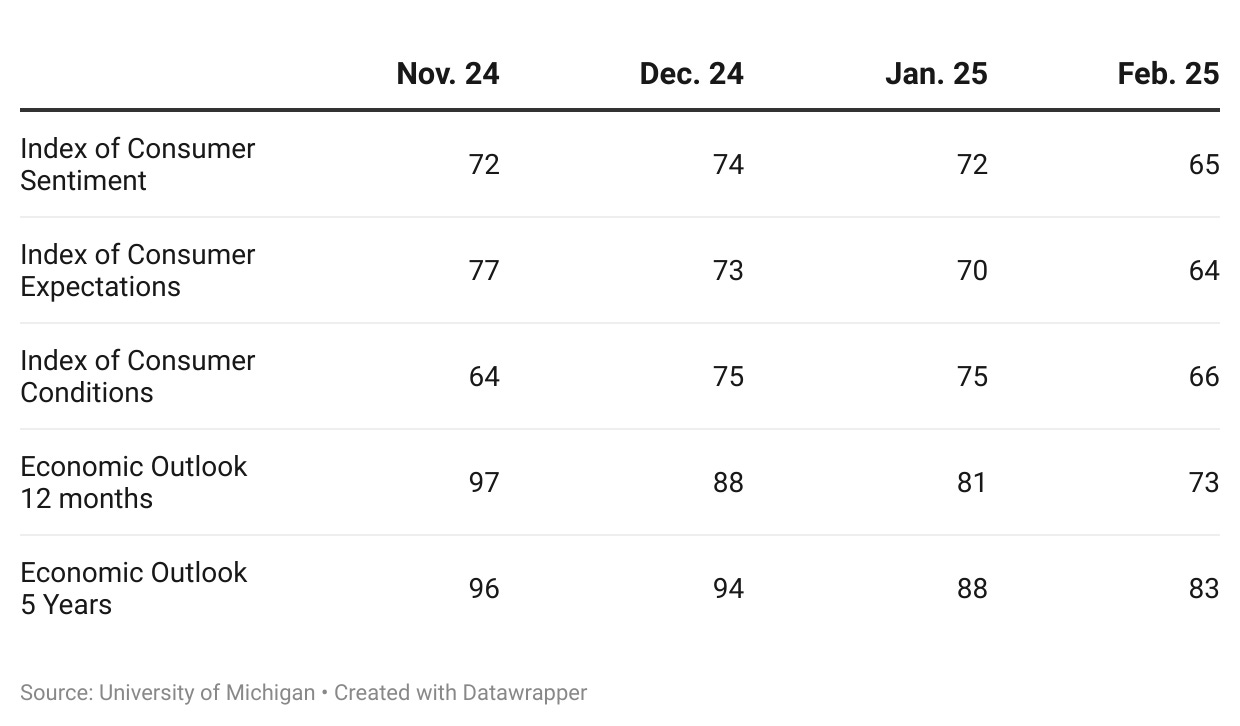

Consumer Sentiment Survey

The University of Michigan Consumer Sentiment survey is a monthly assessment of U.S. consumer attitudes toward the economy, personal finances, and spending conditions. Conducted by the University of Michigan’s Institute for Social Research, it has been a key economic indicator since its inception in the 1940s by Professor George Katona.

Key Features

Methodology:

Sample: At least 500 telephone interviews (historically) or online surveys (starting July 2024) across the contiguous U.S., with a rotating panel design.

Questions: 50 core inquiries covering personal finances, business conditions, and buying conditions, including expectations for inflation, interest rates, and economic growth.

Normalization: The index is benchmarked to 100 in Q1 1966.

Components:

Index of Consumer Sentiment (ICS): Combines current conditions and expectations.

Index of Consumer Expectations: Focuses on future economic prospects.

Index of Current Economic Conditions: Reflects perceptions of present financial health.

Significance

Economic Impact: Consumer spending drives ~68% of U.S. GDP, making sentiment a leading indicator for economic trends.

Policy Relevance: The Expectations Index is included in the U.S. Department of Commerce’s Leading Economic Indicators.

Comparison with Other Surveys

The Conference Board’s Consumer Confidence Index (online, ~3,000 respondents) also tracks sentiment but differs in methodology and scope.

This survey remains pivotal for businesses, policymakers, and investors seeking insights into consumer behavior and economic stability.

Recent Trends

All five index components declined in February, with buying conditions for durable goods experiencing a significant 19% drop, largely driven by concerns over impending price hikes caused by tariffs. The decline was particularly pronounced in the 12-month economic outlook, which fell significantly. Consumers cited high levels of uncertainty around economic policies, making it difficult for them to plan for the future. This uncertainty could lead to reduced consumer spending and investment, therefor GDP.

PCE

The PCE Price Index for February 2025 is scheduled for release today.

Headline PCE Inflation (YoY): Expected to remain steady at 2.5%, unchanged from the previous month.

Core PCE Inflation (YoY): Projected to edge up slightly to 2.7% from 2.6%.

Monthly Change: Both headline and core PCE indices are expected to rise by 0.3%, consistent with January's increase.

As the PCE is the Federal Reserve's preferred measure of inflation, it warrants close attention.

Stocks we are watching today: