Daily Newsletter 3/31/25

Good morning.

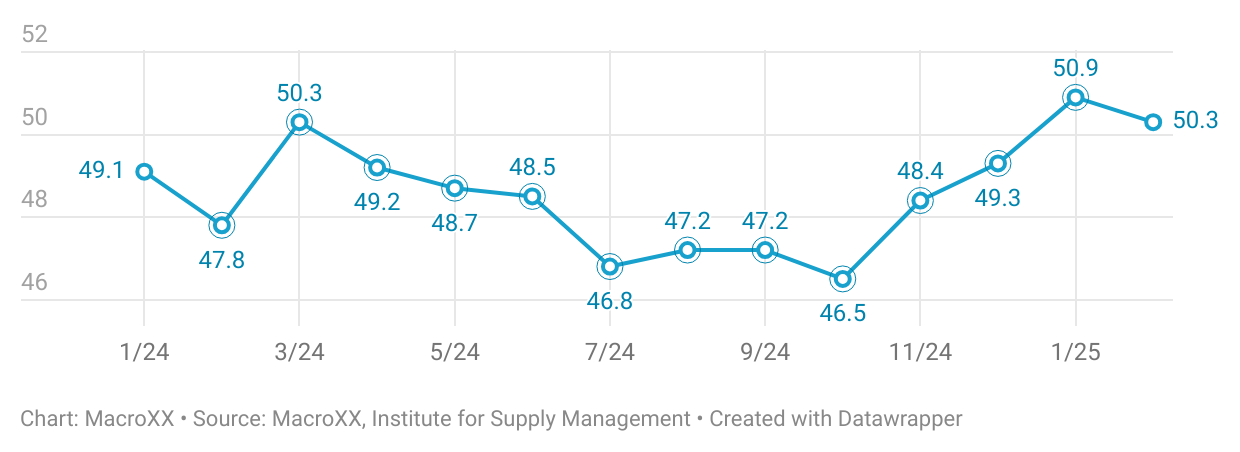

Recession Fears

While it appears that a recession may be on the horizon, possibly a mild one, it’s worth recalling Paul Samuelson’s famous observation about the stock market's predictive power: “The stock market has predicted nine of the last five recessions.” This quip underscores the market’s tendency to signal more downturns than actually occur, highlighting its imperfect reliability as an economic forecaster.

Chicago PMI

The Chicago Business Barometer (Chicago PMI) for March 2025 is scheduled for release today, at 9:45 AM EDT. The market consensus anticipates, indicating continued contraction in business activity within the Chicago area. Although focused on the Chicago area, the index often correlates with broader national economic trends, providing valuable early signals about shifts in business activity across the country. Its release often influences financial markets by shaping investor sentiment and expectations about future economic trends.

In addition to our long-term portfolio, which includes stocks, bonds, and complex options, we also prioritize short-term tactical trades. Today our focus will be on UVIX, GDX and GLD.

UVIX

Here is a snapshot our daily nexletter from 3/27/25.

“We plan to hold UVIX until at least April 2, 2025, in anticipation of the tariff announcement. Our entry point was 29.07. Our exit strategy for this position is structured as follows:

We'll sell 25% of our holdings when the price reaches 35.

Another 25% will be sold at 36.

We plan to offload 40% of the position when the price hits 40.

The remaining 10% will be held for potential higher gains.

Stop-Loss at 26.”

This position has been extremely profitable we closed 25% at $35.00, 25% at $36.00 and 40% at $41.00. 10 % will be hold for potential higher profits. Given that uncertainty persists, we are maintaining a 10% allocation as a precaution against potential spikes in volatility.

GDX

GLD

Today, we provide our daily newletter at no cost. However, if you're interested in accessing our specific entry and exit points, along with real-time trade updates, and gain access to expert insights on macroeconomics and finance, please consider upgrading to a paid subscription. A paid subscription will also grant you access to insights on how we structure our advanced options trades.