Daily Newsletter 4/10/25

Good morning.

The global trade war is intensifying as the U.S. and China sharply escalate their tariffs against each other.

It is uncertain how this high-stakes global economic standoff will unfold, but the mounting economic repercussions are undeniable. Most immediately, trade between the U.S. and China risks grinding to a halt, which would have devastating consequences for both nations.

On the surface, a significant disruption in U.S.-China trade might seem more damaging to China's economy than to the U.S. However, this may not necessarily be the case. China is likely to swiftly redirect its trade by increasing exports to Europe and other Asian countries while sourcing imports from emerging economies. Meanwhile, U.S. businesses, facing high tariffs on all trading partners, will struggle to find cost-effective alternatives for the displaced Chinese goods.

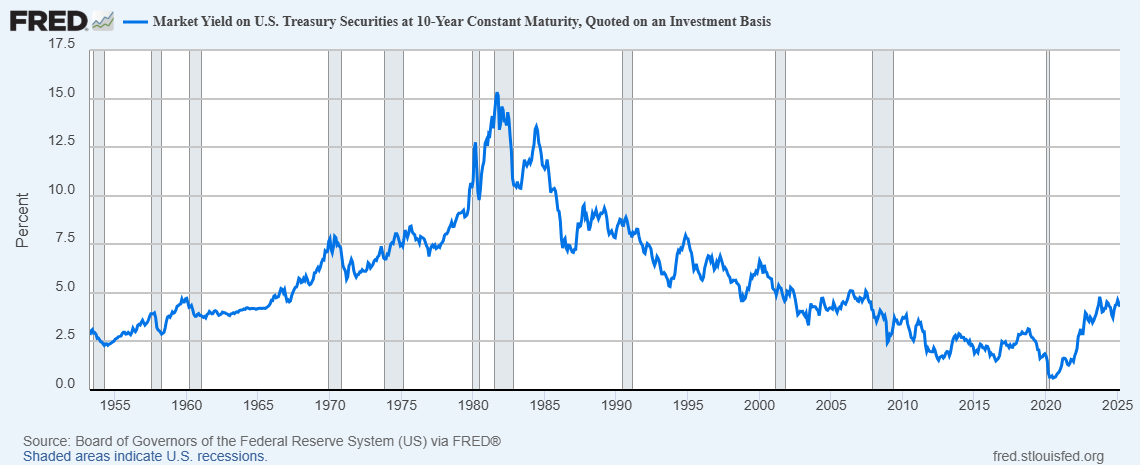

The recent selloff in the bond market and the sharp rise in long-term interest rates are particularly concerning. Despite growing fears of a recession and investor expectations for four to five Federal Reserve rate cuts this year, the 10-year Treasury yield has surged reaching approximately 4.5%. Currently, the yield is at 4.328%.

What triggered the bond selloff?

According to financial theory, declining equity prices should be partially balanced by rising bond prices.This is not the pattern observed in the markets lately.

Several factors are influencing this situation.

First, there is growing concern that global investors may be losing confidence in the U.S. as a reliable safe haven for their savings. This sentiment is further fueled by statements from Trump administration officials questioning whether the U.S. should continue to prioritize its reserve currency status.

Additionally, with U.S.-China trade breaking down, the U.S. trade deficit is expected to shrink significantly. As a result, China will have less capital annually to reinvest in the U.S., including in U.S. Treasury bonds. China is one of the largest foreign holder of U.S. Treasury bonds. As China's Treasury holdings decline due to bond maturities—or potentially through active bond sales—higher interest rates will be required to attract other buyers, such as hedge funds, which are highly sensitive to price changes.

In these circumstances, it is crucial to closely monitor and thoroughly analyze every piece of economic data. Here are some of the economic data we received this morning:

Economic Data Releases in the U.S.:

Inflation Reports:

Core Inflation Rate (MoM): 0.1%, below consensus of 0.3%.

Core Inflation Rate (YoY): 2.8 %, below consensus of 3%.

Overall Inflation Rate (YoY): 2.4%, lower than the forecasted 2.6%.

Jobless Claims:

Initial Jobless Claims: 223K, lower than expected.

Continuing Jobless Claims: 1,850K, lower than expected.

The stock market responded positively to President Trump's announcement of a 90-day pause on most tariffs, leading to a significant rally across global markets.

We believe that a pause in reciprocal tariffs within 90 days was likely to happen anyway, so they essentially accelerated the process and declared it a victory, naturally.

We believe the rally is not permanently over, as a significant number of short positions remain uncovered.

Upgrade to a paid subscription to unlock access to detailed entry and exit points for our trades, real-time trade updates, and expert insights into macroeconomics and finance. Subscribers will also gain exclusive access to advanced options trading strategies and the methodologies behind structuring these trades.