Daily Newsletter 4/25/25

After a three-day rally, the market could pause as investors evaluate recent earnings reports and the outlook for global trade policy.

Recession concerns remain present, although the probability of a mild recession has recently decreased. Ongoing trade negotiations between the U.S. and China could offer markets a temporary reduction in uncertainty.

The Michigan University Consumer Survey

The Michigan University Consumer Survey, officially known as the University of Michigan Consumer Sentiment Index (MCSI), is a monthly survey conducted by the University of Michigan that measures how optimistic or pessimistic American consumers are about the economy.

Consumer sentiment significantly influences the stock market, but the relationship is complex and has evolved over time. Historically, high consumer sentiment—reflecting optimism about personal finances and the economy—has been associated with rising stock prices and bullish markets. Consumer sentiment is often viewed as a lagging indicator, moving in tandem with economic and market cycles. Extreme lows in sentiment can sometimes act as contrarian buy signals—periods when pessimism is high have historically been followed by strong stock market rebounds, as seen after the 2008 financial crisis and other downturns.

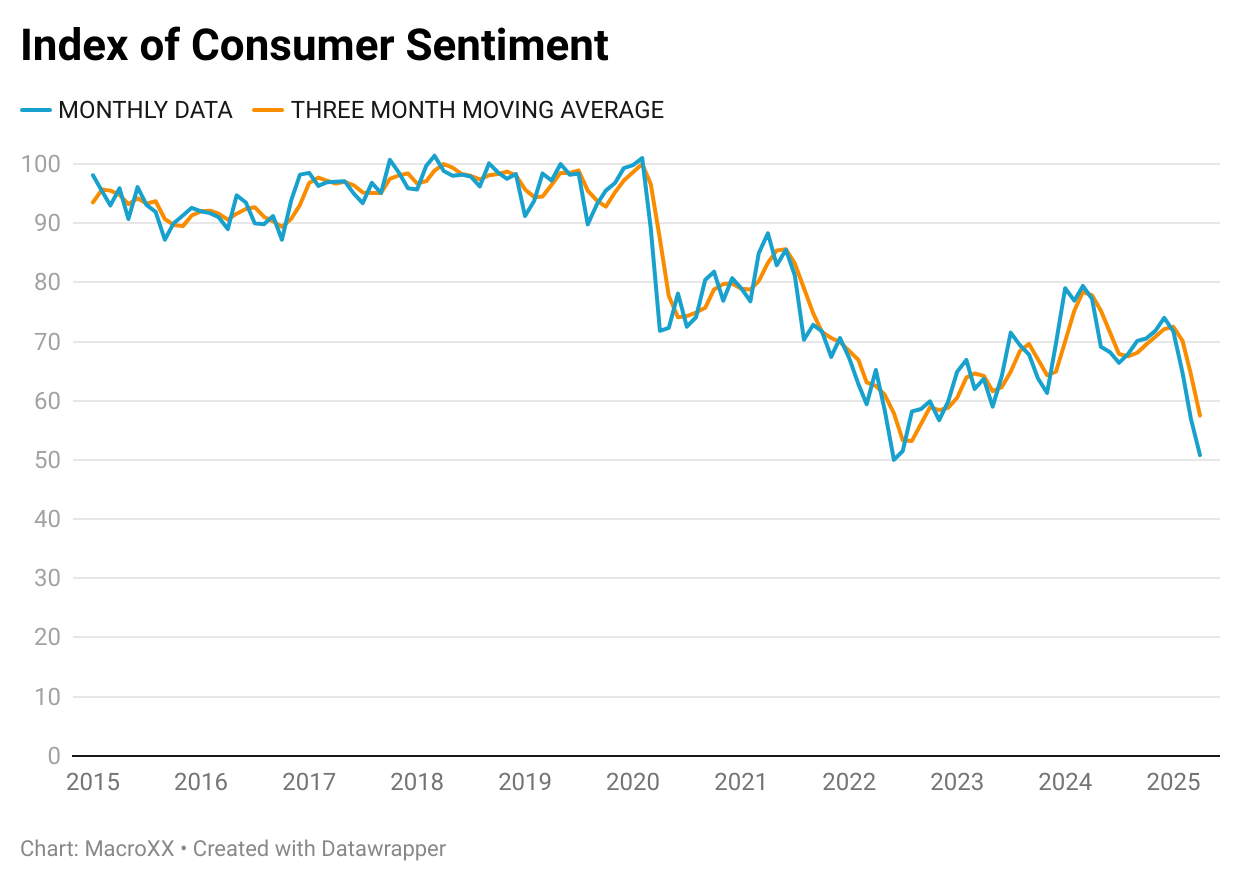

The preliminary data for the University of Michigan Consumer Sentiment Index in April 2025 shows a sharp decline. Index for April 2025, fell to 50.8, marking its lowest level since June 2022 and the second-lowest reading on record since the survey began in 1952. This represents an 11% drop from March’s 57.0 and a decline of more than 30% since December 2024.

Index of Consumer Sentiment: 50.8 (April) vs. 57.0 (March)

Current Economic Conditions: 56.5 (April) vs. 63.8 (March)

Consumer Expectations Index: 47.2 (April) vs. 52.6 (March)

Year-ahead inflation expectations: Jumped to 6.7%, the highest since 1981, up from 5% in March

Five-year inflation expectations: Rose to 4.4% from 4.1%

The decline was “pervasive and unanimous across age, income, education, geographic region, and political affiliation,” according to survey director Joanne Hsu.

Sentiment has now lost more than 30% since December 2024, driven by worries over trade war developments, inflation, and a deteriorating labor market.

The share of consumers expecting unemployment to rise in the year ahead is now more than double the level seen in November 2024 and the highest since 2009.

The survey was conducted between March 25 and April 8, before the partial reversal of tariffs announced on April .

U.S. consumer sentiment plunged in April 2025 to 50.8, reflecting deepening pessimism about economic conditions, inflation, and the labor market, with expectations for unemployment and inflation at multi-year highs

Existing-home sales fell sharply by 5.9% in March to a seasonally adjusted annual rate of 4.02 million units, marking the slowest pace for March since 2009. Sales were also down 2.4% year-over-year. The decline was broad-based, with all four major U.S. regions seeing monthly drops. Inventory of unsold existing homes rose 8.1% from February to 1.33 million units, or a 4.0-month supply. Despite weaker sales, the median existing-home price hit a record high for March at $403,700, up 2.7% from a year ago.

A slowdown in home sales can be an early warning sign of economic weakness, but by itself, it is not a definitive recession indicator. They are best viewed as a potential early signal—especially if accompanied by rising unemployment, falling prices, and higher foreclosure rates. At present, the housing market’s softness is a concern, but not a definitive recession indicator without broader economic deterioration.

At 4:30 PM ET, Neel Kashkari, President of the Federal Reserve Bank of Minneapolis, will deliver remarks that market participants will closely monitor for insights into monetary policy direction and economic outlook.

China has made it clear that if the United States wants to resume trade talks, it must first cancel all unilateral tariffs imposed on Chinese goods. Chinese officials have repeatedly emphasized that there are currently no trade negotiations underway, directly contradicting claims from the Trump administration about ongoing discussions.

The trade war is slowing China’s factory output by dampening export demand, squeezing industrial profits, and creating a more challenging business environment. While stimulus measures have provided some support, the outlook remains uncertain as global trade barriers persist and external demand remains weak.

Germany is now on track for a third straight year without growth—an unprecedented stretch for the country in the postwar era.

Germany has sharply downgraded its economic growth forecast for 2025, now projecting zero growth instead of the previously expected 0.3% expansion. This revision comes amid mounting uncertainty from global trade disputes, particularly the imposition of tariffs by the United States under President Donald Trump. The German government cites these protectionist measures as a major factor weighing on its export-driven economy, which has already experienced two consecutive years of contraction.

Germany’s economic health is deeply intertwined with that of the EU. Its growth drives regional prosperity, while its difficulties can cast a shadow over the entire bloc’s outlook.

OUR TRADES

Amid ongoing market uncertainty and the absence of a clear trend, we are focusing on tactical macro trades and short-term positions, adjusting our strategies throughout the day.

Today, we will be adjusting our trades to prepare for the earnings releases scheduled for next week.

Furthermore, as usual, our focus will remain on global macro trades. Despite the ongoing high level of uncertainty, the global macro environment continues to offer a wide range of trading opportunities.

We invite you to become a paid subscriber to gain exclusive access to our trade recommendations, including buy and sell signals shared directly with our subscribers.