Daily Newsletter 4/29/25

Markets continue to monitor developments in the U.S.-China trade dispute, with any policy news likely to move markets.

Advance U.S. trade balance in goods for March will be released, providing insight into the country’s trade flows.

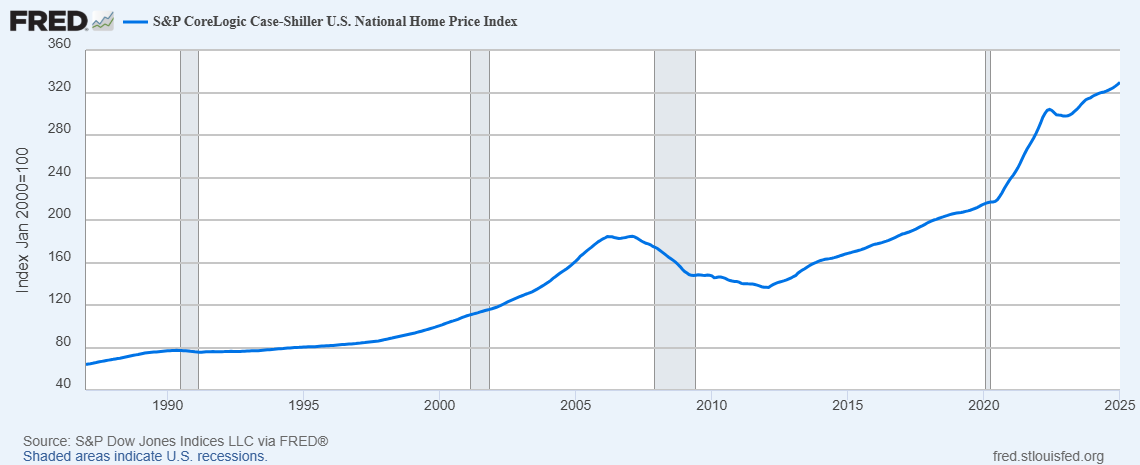

The S&P CoreLogic Case-Shiller Home Price Index is released on the last Tuesday of each month at 9:00 a.m. ET, with the next release scheduled for today. This release will provide updated data on U.S. home prices, reflecting trends in the housing market based on sales of single-family homes across major metropolitan areas. The index is closely watched by economists, investors, and policymakers as a key indicator of housing market health. Housing makes up a large portion of the U.S. economy. It provides a snapshot of the health of the housing market, which in turn reflects broader economic conditions. Rising home prices can signal economic strength, increased consumer confidence, and greater aggregate demand, while falling prices can indicate economic stress and potentially foreshadow a recession. The index is published with a two-month lag, so it reflects past, not current, market conditions.

The index is normalized so that January 2000 equals 100. An index value of 200 means home prices have doubled since January 2000; a value of 250 means prices are 2.5 times higher than in January 2000.

Several major companies reporting earnings today include UPS, Spotify, PayPal, Starbucks, Deutsche Bank, General Motors, Royal Caribbean, Kraft Heinz, and Brinker International, all of which could impact market sentiment. Besides U.S. companies, several international firms are releasing earnings, adding to market volatility.

These events are likely to drive significant market moves and set the tone for the rest of the week.

The next U.S. GDP release is scheduled for Wednesday, April 30, 2025, at 8:30 a.m. EST. This will be the advance estimate for the first quarter of 2025, providing the first official look at economic growth for the year.

May 2, 2025, is a significant date for U.S.-China trade because it marks the implementation of new, stricter tariffs and import restrictions on goods from China and Hong Kong. Starting on this date, the U.S. is ending the "de minimis" exemption for low-value imports (under $800) from China and Hong Kong, meaning these goods will no longer be allowed to enter under simplified customs procedures. Instead, they will be subject to full customs scrutiny and much higher tariffs.

Additionally, from May 2, 2025, small parcels from China and Hong Kong are subject to a specific duty of $100 per item, up from previous lower rates, and this will rise further to $200 per item beginning June. These changes are part of a broader escalation in the U.S.-China tariff war, with the U.S. now imposing up to a 145% tariff on Chinese goods and China retaliating with tariffs as high as 125% on U.S. products.

These measures are expected to significantly disrupt e-commerce platforms and retailers that rely on low-cost Chinese imports, such as Shein and Temu, and will likely increase costs for U.S. consumers and businesses. The May 2 deadline is therefore a major inflection point in the ongoing trade conflict between the U.S. and China.

OUR TRADES

Trading sentiment is mixed, with investors adopting a "wait-and-see" approach amid tariff uncertainty and anticipation of further economic data releases and major tech earnings later in the week.

Recently, our attention has shifted primarily to non-U.S. markets rather than focusing solely on the U.S. We have been recommending adding European ETFs to portfolios, which saw a significant surge in the days preceding their recent rally.

We invite you to become a paid subscriber to gain exclusive access to our trade recommendations, in addition to our educational content. This includes buy and sell signals delivered directly to our paid subscribers.