Daily Newsletter 4/7/25

Good morning.

Global markets are declining due to escalating fears of a trade war and potential economic recession.

Asian markets faced steep losses, with Japan's Nikkei 225 plunging nearly 8%, triggering circuit breakers. Taiwan's Taiex index also saw significant declines.

U.S. stock futures are indicating a downward trend.

We anticipate that today and in the coming days, there will be significant margin calls, leading to the sale of traditionally safe assets, as riskier ones may not generate sufficient liquidity to meet the requirements.

Even central banks may be compelled to intervene to provide liquidity support.

VOLATILITY

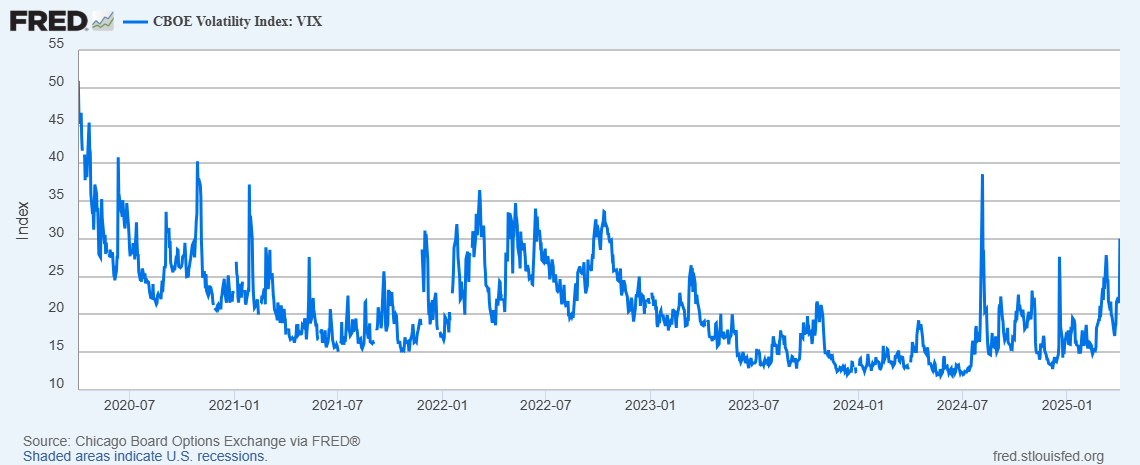

Aside from the widespread decline in stock market indices globally, the key event to focus on is the surge in market volatility.

The VIX, or CBOE Volatility Index, is a real-time index that measures the market's expectations for volatility over the next 30 days based on S&P 500 options prices. Commonly referred to as the "fear index" or "fear gauge," it provides insights into market sentiment, risk, and uncertainty.

Interpretation:

Below 20: Indicates stable markets with low stress.

20–30: Reflects moderate volatility and uncertainty.

Above 30: Signals high volatility, often associated with extreme market events or fear.

A VIX value of 45 has been regarded as a significant threshold.

If you’re looking to trade volatility, one potential instrument to consider is UVIX, a leveraged ETF designed to deliver twice the daily return of the S&P 500 VIX Short-Term Futures Index. The ProShares Ultra VIX Short-Term Futures ETF (UVIX) is a 2x leveraged exchange-traded fund designed to provide daily investment results that correspond to twice the performance of the Long VIX Futures Index. It achieves this by holding first- and second-month VIX futures contracts, which are rolled daily to maintain exposure to short-term volatility.

Upgrade to a paid subscription to unlock access to detailed entry and exit points for our trades, real-time trade updates, and expert insights into macroeconomics and finance. Subscribers will also gain exclusive access to advanced options trading strategies and the methodologies behind structuring these trades.