Daily Newsletter 5/13/25

Markets responded with a strong rally to the U.S.-China trade deal announced yesterday, which featured a substantial, temporary reduction in tariffs between the two countries. The agreement was widely seen as more favorable than anticipated, with reciprocal tariffs dropping from over 100% to 10% for both nations during a 90-day pause.

Global stock markets surged: The Stoxx 600 in Europe rose 1%, Germany’s DAX hit a one-year high, and Hong Kong shares climbed about 3%.

U.S. markets soared: The S&P 500 gained over 3%, the Dow Jones Industrial Average jumped more than 1,100 points, and the Nasdaq Composite rose by more than 4%-its highest close since February.

The U.S. dollar strengthened and gold prices fell, reflecting a shift away from safe-haven assets as recession fears eased.

Bond yields rose and oil prices rebounded, further signaling improved risk appetite.

The market’s direction will hinge on the economic data released today and over the next few days, along with the uninterrupted continuation of the temporary U.S.-China trade relief.

In our view, two data releases today stand out as particularly important compared to the others. U.S. Consumer Price Index (CPI) and Inflation Data (April) and NFIB Small Business Optimism Index (April).

U.S. Consumer Price Index (CPI) and Inflation Data (April)

The April 2025 Consumer Price Index (CPI) data was released on today, at 8:30 AM EST.

Headline Inflation Rate YoY: 2.3%

Headline Inflation Rate MoM: 0.2%

Core Inflation Rate YoY: 2.8%

Core Inflation Rate MoM: 0.2%

CPI: 319.799

Inflation pressures remain moderate, with headline and core inflation both running below 3% year-over-year.

The slight uptick in April reverses March’s decline but does not indicate a surge in inflation.

The report suggests that, while shelter and some energy costs are rising, overall price increases are contained and food prices are softening.

The data may ease concerns about runaway inflation and could support a cautious approach by the Federal Reserve regarding interest rate changes.

The April CPI report points to steady but modest inflation, with no signs of a sharp acceleration. Markets and policymakers will likely view this as a sign that price pressures remain under control.

Futures for the S&P 500 turned positive following the release of the inflation report.

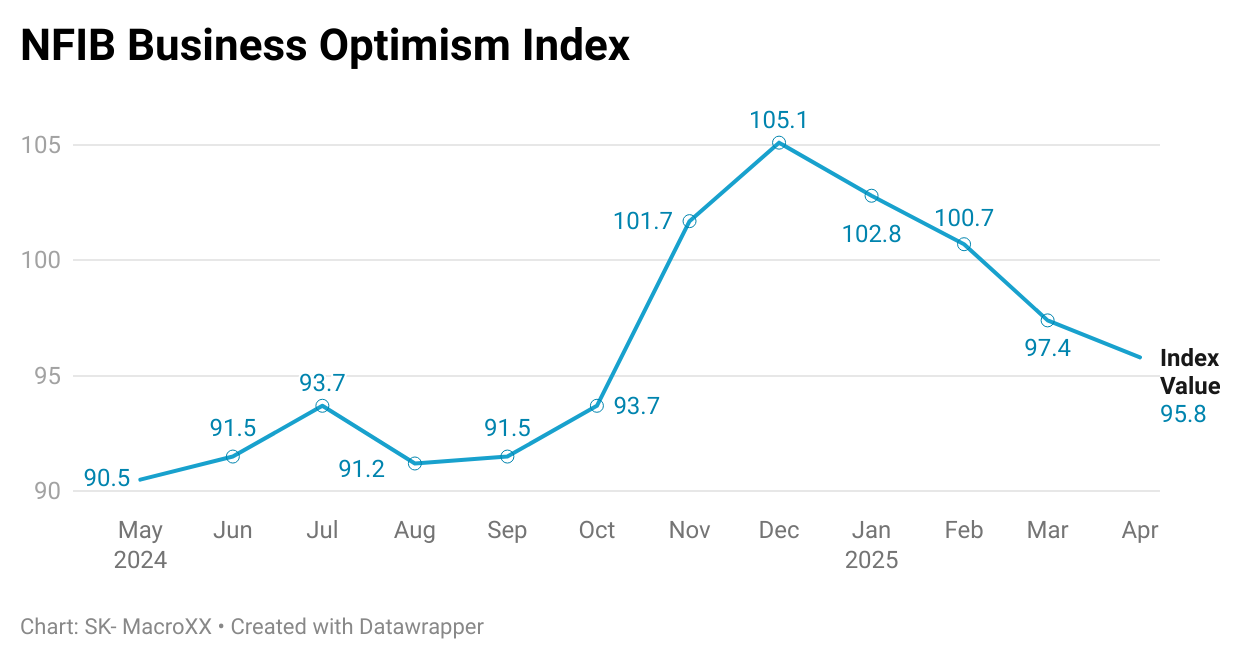

The NFIB Small Business Optimism Index is important because it serves as a key gauge of the sentiment and confidence of small business owners in the United States-a sector that plays a vital role in driving economic growth and job creation.

The monthly NFIB survey is based on a sample of approximately 600 to 1,200 small-business owners who are members of the NFIB, providing a representative snapshot of small business sentiment across the United States.

The survey instrument has changed little since its inception in the 1970s and includes questions about recent business performance, near-term forecasts, and demographics.

It declined by 1.6 points in April to 95.8, the second consecutive month below the 51-year average of 98. The Uncertainty Index decreased four points from March to 92 but remained far above the historical average of 68. Seasonally adjusted, 34% of business owners reported job openings they could not fill in April, down six points from March. The last time job openings were below this level was in January 2021.

The markets have responded positively to the U.S.-China trade agreement. Investors welcomed the deal, which temporarily reduces tariffs significantly more than expected, sparking rallies in global stock markets and boosting risk appetite among investors.

Nevertheless, we are not yet convinced that a lasting bull market is underway. Although it’s a possibility, we feel that additional data is necessary before reaching that conclusion. In our opinion, the market’s direction could quickly change if any negative news arises.

OUR TRADES

Below, you will find our portfolio, which is divided into two sections: the Tactical Portfolio and the Medium-to-Long-Term Portfolio.

We share all entry and exit points of our tactical trades with our paid subscribers, along with detailed explanations for why each trade was initiated.