Daily Newsletter 5/16/25

Today’s key economic events include U.S. housing data, consumer sentiment, TIC data release, Fed speeches, and ongoing market reaction to the U.S.-China tariff truce.

It seems to us that the divergence between institutional and retail investors in U.S. markets reached its highest point this week. While most institutional investors have positioned themselves defensively in U.S. assets due to concerns about a significant economic slowdown, potential recession, and broader worries over U.S. policies and geopolitical tensions, individual investors have largely maintained a bullish outlook.

While other data releases are also important, we believe the COT report will offer significant clarity on this issue, and we plan to analyze it in depth. 4:00 p.m. EST. A special analysis will be delivered to our subscribers.

JPMorgan CEO Jamie Dimon cautioned on Thursday that a U.S. recession is still a real possibility, even after recent tariff reductions, emphasizing that ongoing uncertainty in trade policy continues to dampen business confidence.

Federal Reserve Chair Jerome Powell cautioned on Thursday that long-term interest rates could stay high as the economy encounters more frequent and persistent supply shocks. This, he noted, complicates the Fed’s dual mandate, making it more challenging to balance inflation management with supporting employment growth.

Apple has been accelerating its shift of iPhone production from China to India, aiming to manufacture most iPhones for the U.S. market in India by the end of 2026. This move is part of Apple's broader strategy to diversify its supply chain amid ongoing trade tensions with China.

President Donald Trump has publicly urged Apple not to expand its iPhone production in India, expressing his preference that the company increase manufacturing in the United States instead. Trump told reporters and business leaders that he had spoken to Apple CEO Tim Cook, stating, "We're not interested in you building in India; India can take care of themselves... we want you to produce here" in the U.S.

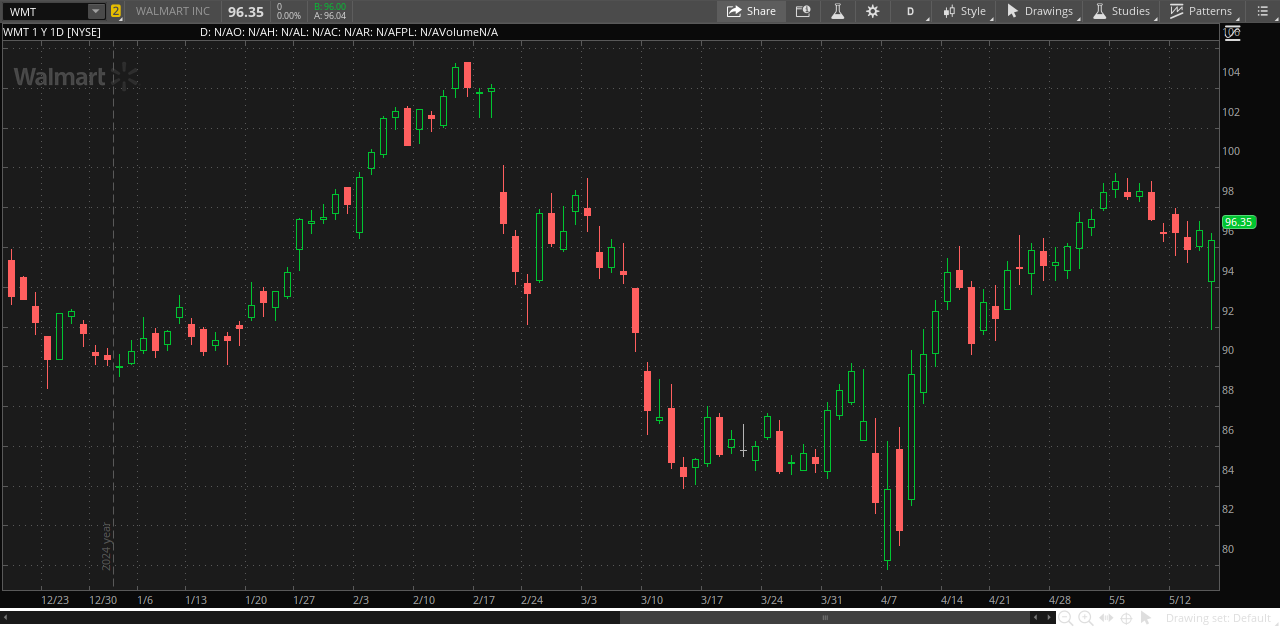

Walmart’s first-quarter earnings for fiscal 2026 beat analyst expectations on both revenue and earnings per share, driven by strong e-commerce growth and higher membership income. However, the market reaction was muted: after the report, stock declined slightly, closing down 0.5% at $96.35.

Despite exceeding expectations with a 4.5% rise in U.S. comparable sales for the first quarter, Walmart warned that higher costs from tariffs-especially those imposed under recent U.S. trade policies-may soon force the company to raise prices for consumers.

CEO Doug McMillon stated, “We will strive to maintain our prices as low as possible, but given the scale of the tariffs, even with the reduced levels announced this week, we cannot absorb all the pressure due to the reality of narrow retail margins”.

Walmart’s vast scale, consumer reach, and central role in the retail sector make its earnings reports a valuable real-time indicator of U.S. economic conditions, consumer sentiment, and emerging risks.

We consider this earnings report-particularly the guidance and CEO’s remarks-extremely important, as Walmart’s immense scale, broad consumer reach, and pivotal role in the retail sector make its results a valuable real-time indicator of U.S. economic conditions, consumer sentiment, and emerging risks.

GOLD

We believe the current dynamics in the gold market demand thorough analysis. That’s why we’re preparing a comprehensive Gold Market Report for our subscribers, to be released this weekend. In addition to fundamental, technical, and macroeconomic analysis of gold prices, the report will examine global gold supply chains, the activities of gold miners and traders, and developments in gold derivatives markets.

OIL

Crude oil prices are trading at $61.19 per barrel this morning. Current U.S. oil prices are generally at or slightly above the average break-even point (BEP) for most U.S. producers.

While trade optimism is providing some support, concerns about rising supply and slowing demand growth continue to weigh on the oil market.

The International Energy Agency raised its global supply growth forecast, projecting a surplus in 2025 as OPEC+ countries unwind production cuts.

U.S. crude inventories unexpectedly rose.

Oil and Middle East:

President Trump’s recent Middle East visit and efforts to ease tensions with Iran are having a direct and complex impact on oil prices.

Oil prices fell sharply after President Trump indicated that the U.S. is close to a nuclear agreement with Iran, raising the likelihood that Iranian oil could return to global markets.

If a U.S.-Iran deal is finalized and sanctions are lifted, we expect a significant increase in Iranian oil exports, contributing to a potential global supply surplus.

OUR TRADES

Below, you will find our portfolio, which is divided into two sections: the Tactical Portfolio and the Medium-to-Long-Term Portfolio.

We share all entry and exit points of our tactical trades with our paid subscribers, along with detailed explanations for why each trade was initiated.

Our service provides comprehensive macroeconomic and financial analysis, as well as educational resources designed for anyone eager to deepen their understanding of the markets and the economy.

If you found this post valuable, we encourage you to become a paid subscriber.

We share our tactical trades with our subscribers, giving you the opportunity to follow our portfolio and build your own based on your personal judgment.