Daily Newsletter 5/19/25

Moody’s downgraded the United States’ long-term credit rating from Aaa to Aa1 on Friday citing concerns over the nation’s rising debt, persistent fiscal deficits, and increasing interest costs.

We are not entirely surprised, as Moody’s had already revised its outlook on the U.S. from “stable” to “negative” in November 2023, indicating that a downgrade was likely if fiscal conditions failed to improve. Moody’s had flagged the risk of a downgrade, citing increased political polarization, debt ceiling standoffs, and instability in congressional leadership as factors undermining fiscal policy effectiveness. This shift from “stable” to “negative” is typically considered a precursor to a potential downgrade.

The downgrade might have occurred much earlier, possibly as soon as the second half of 2024. However, Moody’s likely waited to assess whether the new administration’s approach would effectively address the fiscal challenges before taking action.

Breaking Down Moody’s U.S. Downgrade

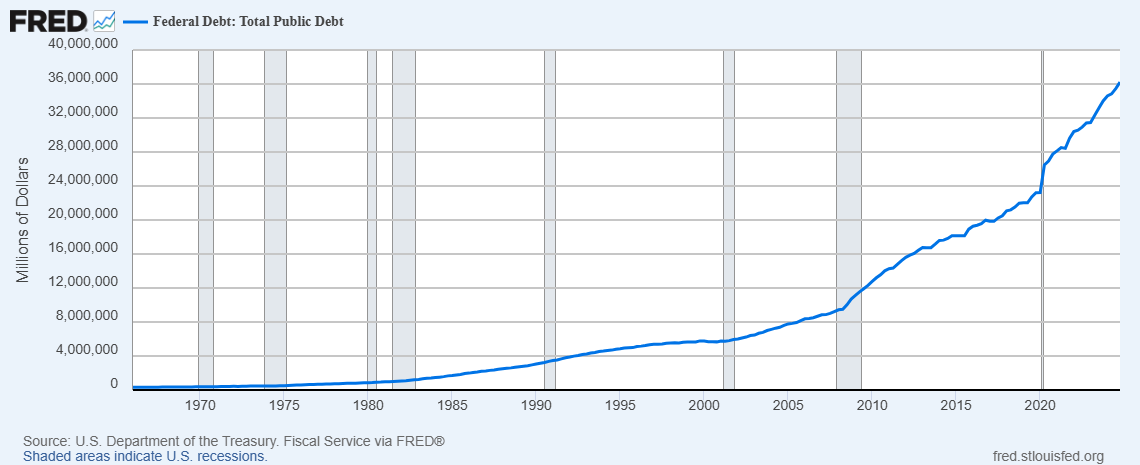

Moody’s pointed to the U.S. government’s escalating debt, which has reached $36 trillion, and persistent large annual fiscal deficits.

The report highlights that interest payments and debt servicing costs have grown to levels “considerably higher than those of similarly rated sovereigns.”

Moody’s points out that successive U.S. administrations and Congress have failed to reach agreement on effective strategies to reduce deficits and manage rising debt costs. The agency does not expect current fiscal proposals to lead to meaningful, sustained deficit reduction.

The downgrade is expected to slightly increase U.S. borrowing costs, as investors may demand higher yields for holding U.S. Treasury debt. Following the announcement, Treasury yields rose and stock markets declined.

Of course, every economic event has its own unique dynamics!

Previous credit rating downgrades have usually triggered short-term market turbulence, frequently causing stock prices to fall and Treasury yields to fluctuate or rise.

Nonetheless, the overall long-term impact on the U.S. economy and government borrowing costs has typically been modest, since global investors continue to view U.S. debt as a secure investment.

For instance, when Standard & Poor’s downgraded the U.S. from AAA to AA+ in August 2011, the markets responded with immediate volatility. Both equities and bonds saw significant fluctuations, although much of the market turbulence was linked to the debt ceiling crisis rather than the downgrade itself. Likewise, when Fitch lowered the U.S. rating from AAA to AA+ in August 2023, it sparked heightened volatility in both stock and bond markets. Treasury yields rose-indicating higher borrowing costs-while stock prices dropped as investors digested the announcement.

The biggest issue with public debt is that persistently rising debt levels can lead to higher borrowing costs for the government, crowd out private investment, and ultimately constrain economic growth. As debt and deficits grow, the government must allocate more resources to interest payments-now the second-largest federal spending item after Social Security-leaving less fiscal space for investments in infrastructure, education, or other priorities. If left unchecked, these dynamics can undermine confidence in the government’s ability to manage its finances, potentially leading to a fiscal crisis or a loss of safe-haven status for government bonds.

Last week’s put/call ratios offer insight into investor sentiment. Here are the CBOE Equity Put/Call Ratios for last week:

May 16, 2025: 0.43

May 15, 2025: 0.52

May 14, 2025: 0.41

May 13, 2025: 0.55

May 12, 2025: 0.50

May 9, 2025: 0.53

The put/call ratios are probably gearing up for a little dance today, especially after Moody’s dropped that downgrade bomb. When big news hits, investors tend to scramble-some grabbing puts like they’re buying umbrellas in a storm, others snapping up calls hoping for a sunny surprise. So expect those numbers to wiggle and jiggle as everyone figures out whether to panic or party. Stay tuned-today’s market moves might just turn the put/call ratio into the latest chart-topper!

OUR TRADES

Below, you will find our portfolio, which is divided into two sections: the Tactical Portfolio and the Medium-to-Long-Term Portfolio.

We share all entry and exit points of our tactical trades with our paid subscribers, along with detailed explanations for why each trade was initiated.

Our service provides comprehensive macroeconomic and financial analysis, as well as educational resources designed for anyone eager to deepen their understanding of the markets and the economy.

If you found this post valuable, we encourage you to become a paid subscriber.

We share our tactical trades with our subscribers, giving you the opportunity to follow our portfolio and build your own based on your personal judgment.