Daily Newsletter 5/20/25

The immediate market reaction to Moody’s downgrade was a dip in equities and a spike in Treasury yields, but both stabilized by the end of the day.

U.S. long-term borrowing costs surged to their highest levels since late 2023 immediately following Moody's downgrade. The yield on the 30-year U.S. Treasury briefly surpassed 5% again, reaching an intraday high not seen since November 2023, before easing back later in the session.

How Much Weight Should We Give This Downgrade?

The downgrade is a reminder of the U.S. government's precarious fiscal standing and the risks associated with ever-rising debt.

While the immediate market impact may be limited, the downgrade could lead to increased borrowing costs for the government and consumers over time.

The downgrade underscores the need for U.S. policymakers to address the growing national debt and implement credible budget plans to reduce deficits.

The downgrade was largely anticipated and serves as a reminder that the U.S. needs to prioritize addressing fiscal issues, particularly public debt.

The public debt issue in the U.S. refers to the rapid and sustained growth of the federal government's outstanding debt, which has reached historic highs and is projected to keep rising.

A budget deficit happens when a government spends more money than it receives in a given period. In the last 50 years, the U.S. federal government has had a surplus budget only four times, with the last one occurring in 2001.

Public debt in the U.S. is primarily caused by the government consistently spending more than it collects in revenues, resulting in annual budget deficits. These deficits accumulate over time to form the national debt.

For fiscal year 2024, the U.S. federal budget deficit was approximately $1.83 trillion, with total government spending at $6.75 trillion and total revenue at $4.92 trillion. This deficit equaled about 6.4% of gross domestic product.

As of the end of 2024, the U.S. government debt-to-GDP ratio stands at approximately 124%. This means the total federal debt is about 124% of the country’s annual economic output.

Among advanced economies in 2025, the average debt-to-GDP ratio is about 110%. Some notable examples include:

Japan: 235 % (the highest among advanced economies)

United States: 123%

France: 116%

Canada: 113%

Germany: Lower than the advanced economy average, though the exact figure is not specified in the latest data.

In comparison, emerging market and developing economies have a much lower average debt-to-GDP ratio, around 74%.

Why Is Fiscal Health Important for an Economy?

Rather than delving into a detailed theoretical explanation, let’s simplify things by focusing on a single scenario. Imagine the U.S. economy falls into a recession. To address this, the government typically relies on two main sets of tools: fiscal policy and monetary policy. However, if public debt is already at unsustainable levels, implementing fiscal stimulus—often a crucial response during recessions, regardless of economic philosophy—becomes extremely difficult. This can make the downturn more painful for the economy. In short, maintaining fiscal flexibility is essential.

The good news for the U.S., at least for now, is that under Basel III regulations, there is no distinction within the highest "Grade A" category. This means there is technically no difference between Aaa and Aa1 ratings when it comes to secure holdings. As a result, banks are not required to sell their holdings due to the downgrade, making an immediate market disruption unlikely. However, additional downgrades would certainly have serious long-term consequences.

Several Federal Reserve officials are scheduled to speak today.

It’s crucial to understand and assess the Fed’s position. While there is ongoing debate about the extent of the Fed’s impact on the economy, we believe that, at least for the foreseeable future, the Fed’s importance will remain elevated due to its continued dominance in financial markets.

9:00 a.m. ET: Richmond Fed President Tom Barkin will speak on growth in rural communities at the Investing in Rural America Conference in Roanoke, Virginia.

9:00 a.m. ET: Atlanta Fed President Raphael Bostic will deliver welcome remarks at the 2025 Financial Markets Conference, hosted by the Federal Reserve Bank of Atlanta.

9:30 a.m. ET: Boston Fed President Susan Collins will provide remarks at a closed "Fed Listens" event in Keene, New Hampshire.

1:00 p.m. ET: St. Louis Fed President Alberto Musalem will discuss the U.S. economy and monetary policy at the Economic Club of Minnesota in Minneapolis.

5:00 p.m. ET: Fed Governor Adriana Kugler will give a commencement address at the Spring 2025 Berkeley Economics Commencement Ceremony.

7:00 p.m. ET: San Francisco Fed President Mary Daly and Cleveland Fed President Beth Hammack will deliver keynotes at the Financial Markets Conference.

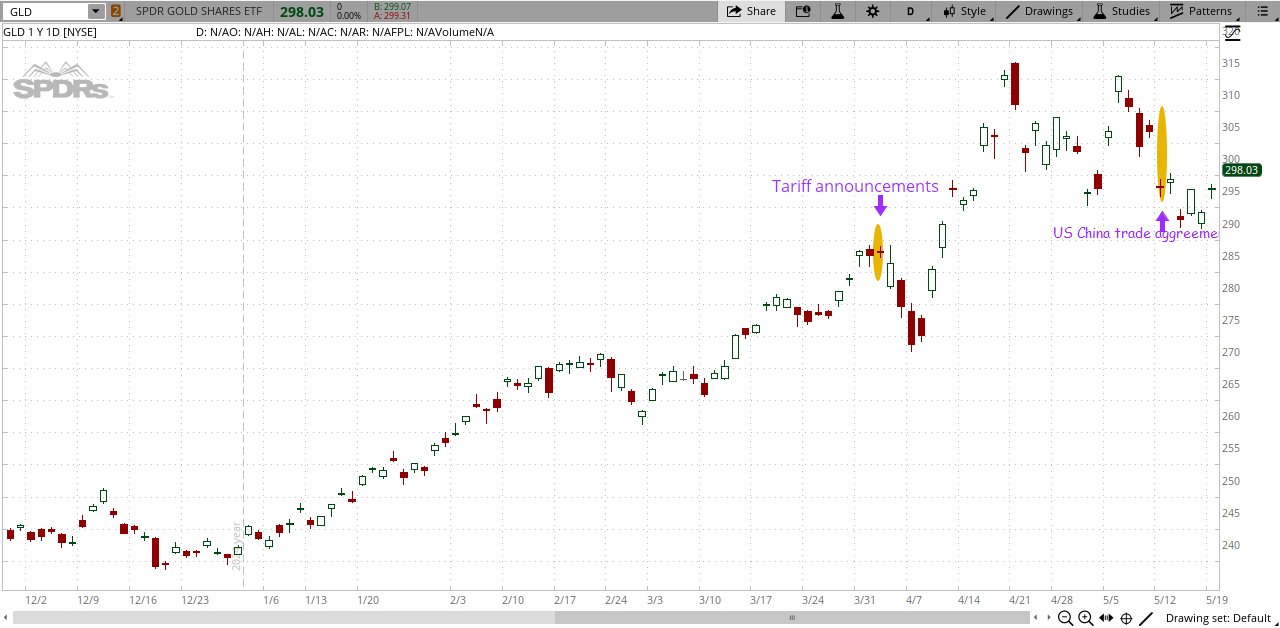

GOLD

We think the gold market warrants close monitoring right now.

The recent rebound in gold was driven by increased safe-haven demand following Moody’s downgrade of the U.S. credit rating, as well as a weaker U.S. dollar, which enhanced gold’s appeal to international investors. While gold is currently technically overbought and appears crowded, the prevailing conditions suggest that further upward movement in gold prices would not be surprising in the short or even the medium term.

OUR TRADES

Below, you will find our portfolio, which is divided into two sections: the Tactical Portfolio and the Medium-to-Long-Term Portfolio.

We share all entry and exit points of our tactical trades with our paid subscribers, along with detailed explanations for why each trade was initiated.

Our service offers in-depth macroeconomic and financial analysis, along with educational resources tailored for those looking to expand their knowledge of the markets and the economy.

If you found this post helpful, we invite you to join us as a paid subscriber.

Subscribers gain access to our tactical trade ideas, allowing you to track our portfolio and make informed decisions as you build your own.