Daily Newsletter 5/22/25

The most important event in the markets today is the Congressional vote on President Donald Trump’s sweeping tax and spending bill.

The tax bill passed the House of Representatives early this morning by a narrow margin of 215-214, with all Democrats and two Republicans voting against it. This marks a significant victory for House Republicans after intense negotiations and last-minute amendments to secure enough support.

However, the legislation is not yet law—it now moves to the Senate, where it faces further debate and potential revisions before it can reach President Trump’s desk for signature.

Trump’s tax bill is the headline act in today’s financial drama, and here’s why it matters: this isn’t just another piece of legislation—it’s a potential game-changer for the entire US economy and global markets.

If passed, the bill would extend the 2017 tax cuts, introduce new tax breaks, and ramp up spending, but it comes with a massive price tag: it could add up to $3.8–$5 trillion to the national debt over the next decade. Treasury yields have surged and stocks have taken a beating.

The bill is also fueling fierce debate in Congress, with Republicans divided and Democrats united in opposition, making its fate anything but certain.

Nonpartisan estimates project the bill would add between $2.5 trillion and $5 trillion to the federal debt over the next decade, with the Congressional Budget Office specifically estimating a $3.8 trillion increase. This is because the bill extends the 2017 tax cuts, introduces new breaks like no taxes on tips and overtime, and adds deductions for seniors and certain business expenses, all of which reduce government income.

To help pay for these tax cuts, the bill proposes cuts to programs like Medicaid and SNAP (food stamps).

While the White House argues that the bill’s mix of economic growth and spending cuts will balance out its costs, independent analysts say the reality is quite different: the revenue lost from tax cuts would far exceed any savings or growth, leading to a much larger deficit and national debt.

Why Should You Care About Public Debt?

The deficit is the amount by which the government’s spending exceeds its revenue in a single year—it’s like spending more than you earn in a given year.

The debt, on the other hand, is the total amount the government owes over time, which is the accumulation of all past deficits (minus any surpluses). Picture the deficit as the government’s annual splurge—spending more than it brings in for the year. The debt? That’s the giant credit card balance that keeps growing every time Uncle Sam overspends. One is this year’s shopping spree; the other is the bill that keeps piling up!

Public debt—also known as government debt or sovereign debt—is the total amount of money a government owes to creditors as a result of borrowing to cover budget deficits. This debt is built up when government spending exceeds revenue, and the government borrows money by issuing bonds and other securities to individuals, businesses, other governments, and institutions.

Public debt can be owed to domestic lenders (internal debt) or to foreign lenders (external debt). It is often expressed as a percentage of a country’s GDP to indicate how manageable the debt is relative to the size of the economy. In the United States, public debt includes both debt held by the public (such as investors, foreign governments, and the Federal Reserve) and intragovernmental debt (owed by one part of the government to another, like the Social Security Trust Fund.

Here’s a link where you can dive into detailed analysis of the national debt.

DebtClock.org is a website that provides a real-time, constantly updating snapshot of the United States’ national debt, along with a wide range of related financial data. It displays not only the total US national debt but also breaks it down into debt per citizen and per taxpayer, federal spending, deficits, and even the debt-to-GDP ratio.

The tax bill’s projected impact on the national debt was a key factor in Moody’s decision to lower the U.S. credit rating, making the two developments directly connected.

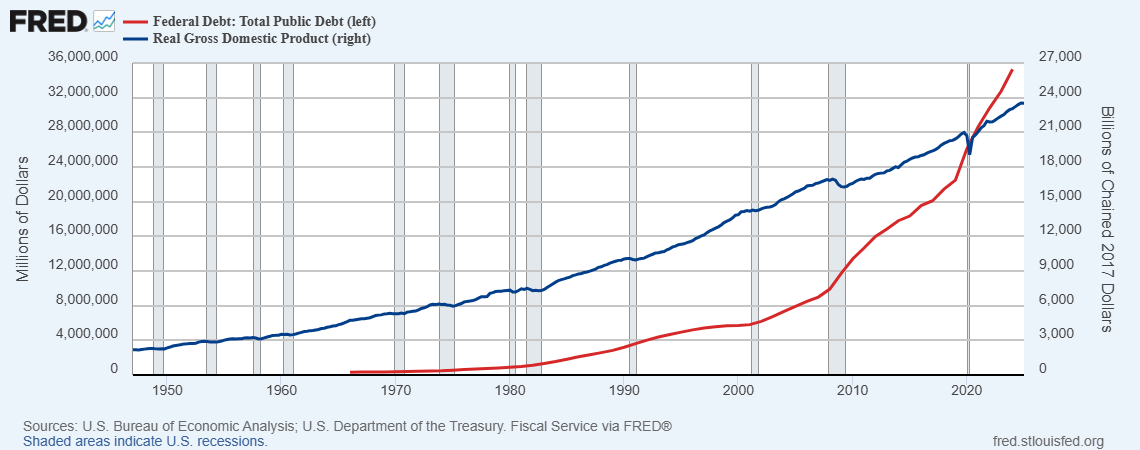

The U.S. public debt surpassed 100% of GDP in 2019, reaching a debt-to-GDP ratio of 100.12% that year. This milestone marked the first time since World War II that the U.S. debt exceeded the size of the entire economy. The ratio climbed even higher during the COVID-19 pandemic, peaking at around 124–130% in 2020–2021 due to emergency spending and economic contraction. Take a look at the chart below.

High public debt comes with a range of consequences, and we’ve highlighted some of the most significant ones below. But remember, at the end of the day, the real challenge with soaring public debt is whether the government can keep finding buyers for its newly issued Treasuries.

When public debt gets too high, it’s like putting the economy on a treadmill with the speed cranked up—harder to keep up, and a lot riskier! Here’s what can happen:

Crowded House: The government’s borrowing spree means it’s competing with businesses and families for loans, which can push interest rates higher and make it tougher for everyone else to invest or spend.

Interest Eats the Budget: More debt means more of your tax dollars go straight to interest payments, leaving less for things we actually care about—like schools, roads, and national defense.

Risky Business: If investors start doubting the government’s ability to pay its bills, borrowing costs can skyrocket or, worse, the money tap could get turned off completely.

No Cushion for Crises: With so much debt, there’s less wiggle room to respond when emergencies hit—think natural disasters or economic downturns.

Inflation Nation: High debt can help fuel inflation, making everything from groceries to gas more expensive and shrinking the value of your paycheck.

A Heavier Backpack for the Next Generation: If debt keeps piling up, our kids and grandkids could face higher taxes, fewer public services, and a lower standard of living than we enjoy today.

Debt Tsunami: How Soaring Public Debt Can Rock Stocks, Gold, Crypto, and the Dollar?

High public debt can send shockwaves through financial markets, affecting everything from stocks to gold, bitcoin, and the U.S. dollar. Here’s how:

Our service offers in-depth macroeconomic and financial analysis, along with educational resources tailored for those looking to expand their knowledge of the markets and the economy.

If you found this post helpful, we invite you to join us as a paid subscriber.

Subscribers gain access to our tactical trade ideas, allowing you to track our portfolio and make informed decisions as you build your own.