Daily Newsletter 5/23/25

As markets were still digesting yesterday’s mixed data, last Friday’s Moody’s downgrade, and fresh tax bill headlines, President Donald Trump jolted investors again this morning by proposing a sweeping 50% tariff on all European Union imports, effective June 1—a move he frames as retaliation for stalled trade negotiations and what he calls the EU’s tough trade barriers.

As anticipated, U.S. futures are trading lower and the VIX has climbed.

VIX

GOLD

Gold soared past $3,550 per ounce this morning.

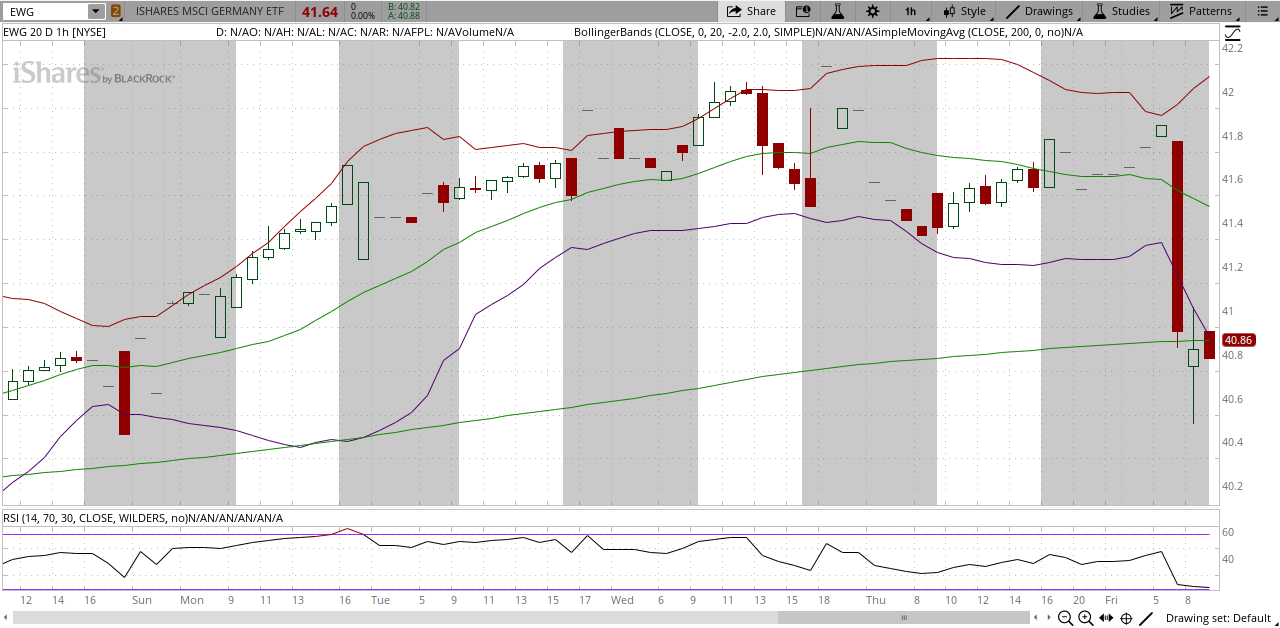

European financial markets also saw an immediate drop following Trump’s tariff announcement this morning. For example, the EWG (iShares MSCI Germany ETF) experienced a sharp decline, reflecting the broader sell-off across European indices as investors reacted to the escalating trade tensions.

EWG

Initial jobless claims reported yesterday (for the week ending May 17) fell by 2,000 to a seasonally adjusted 227,000.

This figure was slightly below economists’ expectations of 230,000 and marks a four-week low, suggesting continued stability in the labor market despite rising economic uncertainty.

The S&P Global Flash US Manufacturing PMI, released yesterday, rose to 52.3 in May 2025 from 50.2 in April, marking the highest level in three months and signaling the strongest improvement in business conditions since June 2022.

Existing home sales in the U.S. were reported yesterday for April 2025, showing a 0.5% decline from the previous month to a seasonally adjusted annual rate of 4.00 million units—the slowest April pace since 2009 and below economists’ forecasts of 4.10 million.

As we've highlighted in our recent emails and app chats, there are a number of potential challenges ahead—including the medium- to long-term effects of tariffs, the risk of escalating trade wars, fiscal concerns tied to rising debt, and ongoing geopolitical tensions. Markets have been searching for clear direction for some time, and despite underlying economic headwinds, investors remain eager to seize on any positive developments. The real question is how sustainable any resulting rally might be, and whether it can deliver a meaningful boost to the broader economy. We're keeping a close eye on global markets, ready to spot any signals and respond swiftly to changing conditions.

OUR TRADES

Below, you will find our portfolio, which is divided into two sections: the Tactical Portfolio and the Medium-to-Long-Term Portfolio.

We share all entry and exit points of our tactical trades with our paid subscribers, along with detailed explanations for why each trade was initiated.

Our service offers in-depth macroeconomic and financial analysis, along with educational resources tailored for those looking to expand their knowledge of the markets and the economy.

If you found this post helpful, we invite you to join us as a paid subscriber.

Subscribers gain access to our tactical trade ideas, allowing you to track our portfolio and make informed decisions as you build your own.