Daily Newsletter 5/8/25

As anticipated, the Federal Reserve’s remarks yesterday, highlighted a cautious and patient approach amid growing economic uncertainty. The Fed kept its benchmark interest rate unchanged at 4.25–4.50%, despite political pressure for cuts, particularly from President Trump. Chair Jerome Powell noted that while the economy remains strong-with low unemployment and moderating inflation-uncertainty has increased due to new tariffs and mixed economic signals, including a recent slowdown in GDP growth.

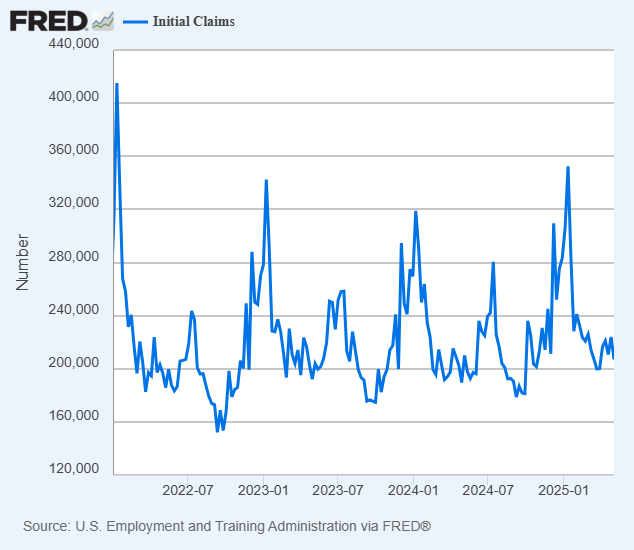

Initial jobless claims fell to 228,000, down 13,000 from the prior week’s unchanged total of 241,000. The four-week moving average rose slightly to 227,000, an increase of 1,000 from the previous week’s unrevised average of 226,000.

While the labor market shows signs of resilience with the recent drop in initial claims, the elevated levels compared to earlier months suggest some caution as economic uncertainties, such as tariffs and mixed growth signals, continue to affect employment dynamics.

The absence of an increase in the unemployment rate, coupled with even a modest decline in jobless claims, indicates a more complex environment for the Fed as it pursues its dual mandate.

If there are no clear signs of weakness in the labor market, the Fed’s attention will remain on inflation. Given that tariffs are likely to push prices higher over time, it’s reasonable to expect that, for now, the Fed will maintain its “higher for longer” stance on interest rates, even if future rate peaks are lower than before.

However, we still anticipate at least three rate cuts in 2025, likely beginning in June or July. We expect the Fed to follow through on its guidance and cut rates once there is clear evidence that unemployment is trending upward.

Most major central banks are now cutting rates or holding steady, responding to slower growth and global trade uncertainty, especially from U.S. tariffs.

The European Central Bank (ECB) cut all three of its key interest rates by 25 basis points in April 2025, lowering the deposit facility rate to 2.25%, the main refinancing rate to 2.40%, and the marginal lending facility to 2.65%. The ECB’s rate cuts are a response to slowing inflation and weaker growth in Europe, aiming to support demand and ensure inflation meets its 2% target. In contrast, the Fed is holding rates steady due to lingering i.nflation risks, especially from tariffs, and a still-solid labor market.

The Bank of England lowered its benchmark rate from 4.5% to 4.25% today, marking its fourth rate cut since last summer.

Oil prices, which had fallen sharply after the OPEC+ decision to increase supply pushed prices to multi-year lows, are now climbing again as optimism grows around ongoing trade negotiations.

The European Union is preparing to impose tariffs on Boeing aircraft as part of a broader package of retaliatory measures. This could mark the beginning of a new round of tariff escalation between the US and Europe, and how the situation will unfold remains uncertain.

Market volatility eased somewhat following the FOMC rate announcement.

We remain unconvinced, even after the Fed’s press conference, that the risk of a mild recession has fully disappeared. In addition, ongoing uncertainty surrounding tariffs leads us to believe that market volatility will likely persist, at least in the near term.

If you found this post helpful, we invite you to become a paid subscriber. Our service offers in-depth macroeconomic and financial analysis, along with educational resources for anyone looking to expand their knowledge of the markets and the economy.

As a paid member, you’ll also gain immediate access to our portfolio.

OUR TRADES

Despite anticipating increased volatility following the Fed announcement, we made only minor adjustments to our tactical portfolio.