Daily Newsletter 6/13/25

Growing developments in Iran are causing futures to decline this morning.

Given the already extremely high level of uncertainty, we expect the market reaction to be negative, but the duration of this response remains highly unpredictable.

Trade tensions and geopolitical conflicts, such as the current escalation between Israel and Iran, can have immediate and significant effects on global financial markets. Typically, these events trigger a "risk-off" reaction among investors, leading to sharp declines in stock markets and a surge in demand for safe-haven assets like gold and government bonds. Oil prices often spike due to concerns over potential disruptions in supply, especially when conflicts involve major oil-producing regions like the Middle East.

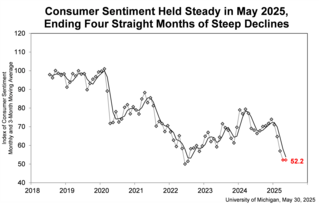

The University of Michigan Surveys of Consumers report is scheduled for release today at 10:00 AM EST.

The Michigan Consumer Sentiment report is important because it serves as a leading economic indicator, offering insights into how optimistic or pessimistic U.S. consumers feel about their personal finances and the broader economy. Since consumer spending accounts for about 68% of U.S. GDP, shifts in sentiment can signal changes in spending behavior, which directly impacts economic growth.

A higher sentiment reading typically indicates greater consumer confidence, which can lead to increased spending and economic expansion. Conversely, a lower reading suggests caution or pessimism, potentially leading to reduced spending and slower economic growth. Policymakers, businesses, and investors closely watch this report to gauge future economic trends and make informed decisions.

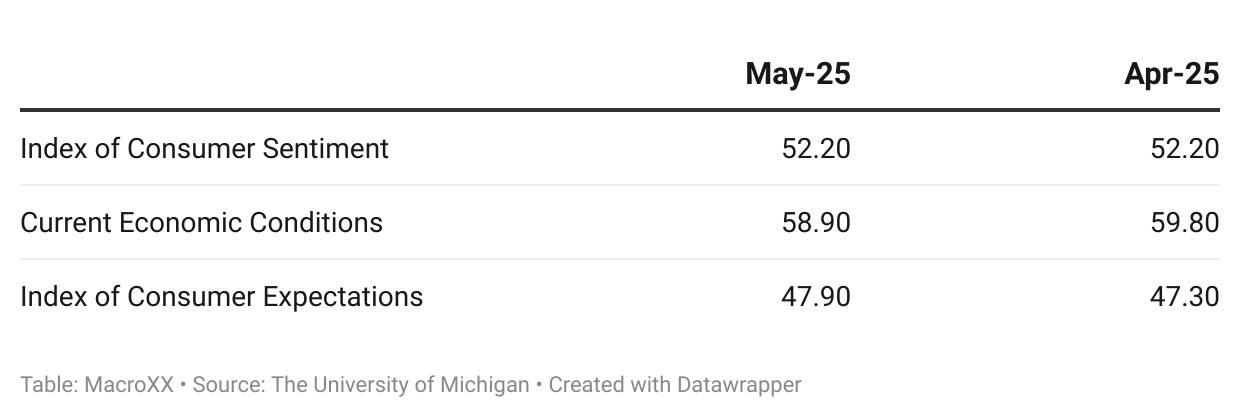

The University of Michigan Surveys of Consumers is composed of several key parts that gauge consumer attitudes and expectations about the economy. The main components include the Index of Consumer Sentiment, the Index of Current Economic Conditions, and the Index of Consumer Expectations. These indices are constructed from responses to core questions about personal finances, business conditions, and purchasing plans for major household items.

Beyond these headline indices, the survey covers a broad range of topics such as expectations for income, wealth, prices, and interest rates, with each monthly survey containing about 50 core questions. The insights drawn from these responses provide valuable information on consumer spending behavior and economic outlook, making the survey a closely watched indicator for policymakers and market participants.

Subscribe to MacroXX to unlock the rest.