Daily Newsletter 6/26/25

Oil

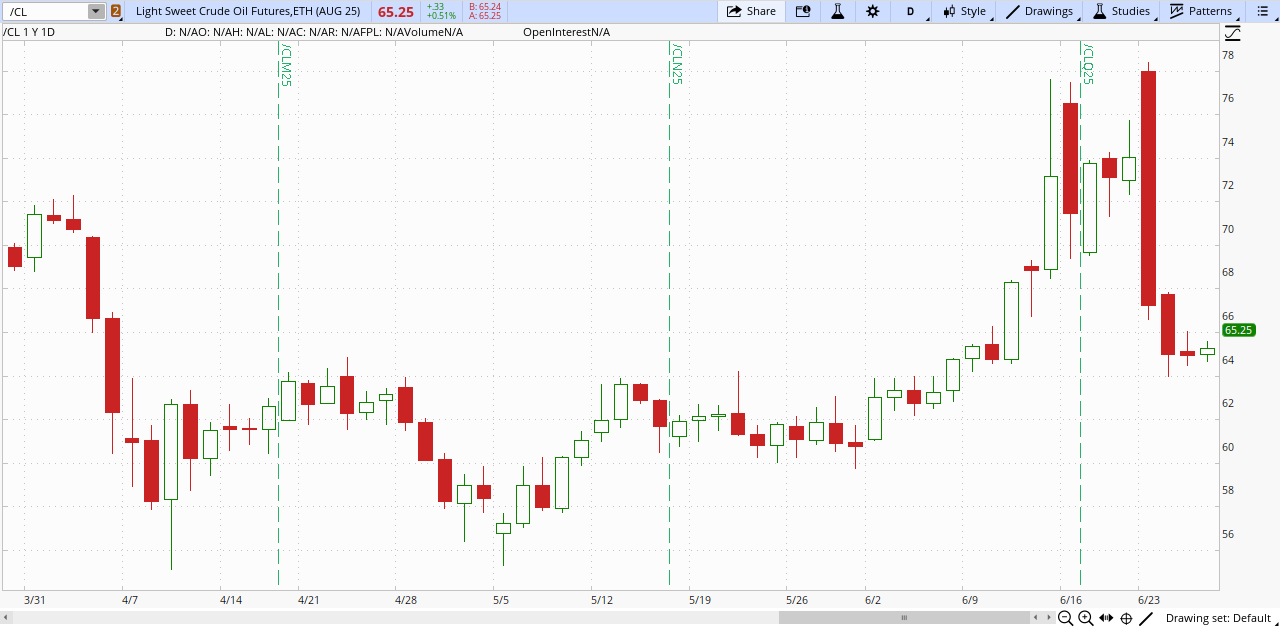

We have maintained, and continue to hold in part, a substantial position in oil futures contracts expiring in August. Following the recent price spike, we retained the position; however, as oil prices began to decline, we partially liquidated approximately two-thirds of these contracts with a relatively significant profit achieved in a short period. It is important to note that the long option on the oil futures is currently out-of-the-money. ("Out of the money" (OTM) is a term used in options trading to describe an option that currently has no intrinsic value. This means that exercising the option would not be profitable at the present market price.)

We intend to retain our options on oil futures until there is greater clarity regarding the forthcoming OPEC+ decision. In our view, the actions taken by OPEC+ have the potential to lead the markets toward a new equilibrium.

The last trading day for August 2025 WTI crude oil futures (CLQ25) is July 22, 2025.

The next OPEC+ meeting is scheduled for July 6, 2025. At this meeting, the eight participating OPEC+ countries will decide on oil production levels for August 2025. This follows their recent agreement to increase output by 411,000 barrels per day in July, with the possibility of further adjustments depending on evolving market conditions.