Daily Newsletter 6/3/25

The market has certainly made a strong comeback from its earlier fears—just a little while ago, investors seemed to be pricing in a recession, or at least bracing for one. But now, it almost feels like the worst has been forgotten. The week kicked off with the market looking a little under the weather, but by Monday’s close, it had found its second wind and finished on a stronger note. We think this rebound was fueled by a strong rally among energy producers and big tech stocks, along with a dose of optimism about possible future trade talks between U.S. and Chinese leaders—a reminder that even amid uncertainty, positive signals can spark a market turnaround.

That said, we don’t think the underlying economy is quite as healthy as this rebound suggests. Growth is still sluggish, and the ongoing tariff war is only adding to the confusion and uncertainty.

In fact, we’d argue that the market has bounced a bit too far, too fast. It’s as if traders are looking past the current economic slowdown and the messy, unpredictable effects of tariffs, hoping for the best. But with so much still up in the air—especially when it comes to global trade and policy—it’s worth keeping a close eye on the fundamentals. History shows that markets can get ahead of themselves, and right now, we worry we might be seeing just that. So, while it’s tempting to get caught up in the rally, we think a little caution is in order.

The ballooning deficit is shaping up to be one of the biggest economic challenges on the horizon. If the current budget plan goes into effect, we’re looking at a significant jump in the deficit this year—a move that could put extra pressure on the government’s finances and rattle investor confidence. But here’s the twist: the Senate still has to weigh in, and their vote will almost certainly reshape the final outcome, possibly softening the blow or redirecting priorities.

Meanwhile, the picture isn’t any brighter when it comes to tariffs. Despite high hopes for boosting revenues, the actual income from tariffs is set to fall well short of targets. This means the government will be missing out on a key source of funding, adding another layer of uncertainty to an already complex fiscal landscape. All in all, it’s a reminder that economic policy is a balancing act—and right now, the scales are tipping toward some tough choices ahead.

On the flip side, let’s not lose sight of the fact that there are some rock-solid pillars in the economy that continue to stand strong. These foundations give us plenty of reasons to stay hopeful, even when the headlines get a little gloomy.

We’re always keeping an eye on those healthy economic foundations—the real building blocks that keep the market steady even when things get a little wobbly. But what exactly are these pillars, and why do we still have such strong faith in them? That’s a story worth telling in depth. So, stay tuned: in a separate post, we’ll break it all down for you—exploring what makes these fundamentals so reliable, why we continue to trust them, and how they might shape your next investment move.

That said, we know it’s never wise to get carried away by optimism alone. We like to keep a healthy dose of reality in the mix—staying alert to risks, watching for warning signs, and always being ready to adjust our outlook as new data rolls in. It’s this balanced approach—optimism grounded in real-world evidence—that helps us navigate the ups and downs of the market with confidence.

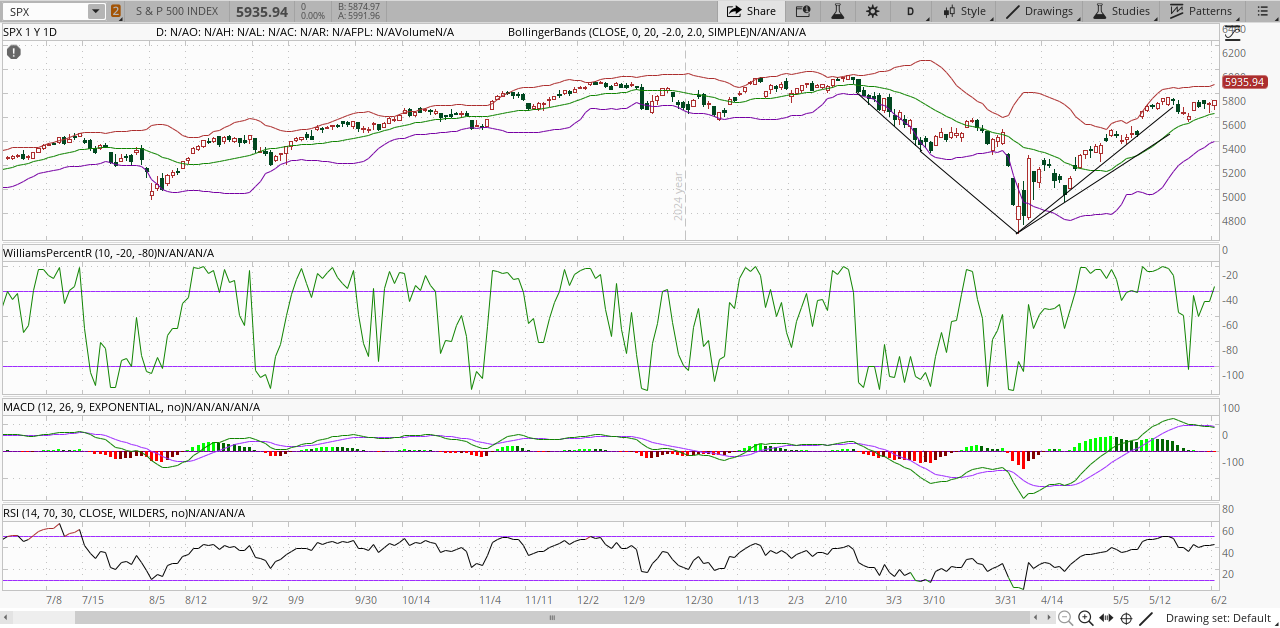

We’d love to give you a glimpse into our typical technical analysis routine for the S&P 500 (SPX). These days, it often feels like breaking news and headlines are stealing the spotlight, making it easy to lose sight of the signals that really move markets.

That’s exactly why we want to emphasize—no matter if you’re a veteran trader or just dipping your toes into the markets—how crucial it is to pay attention to both technical and fundamental analysis. Each offers unique insights, and together they give you a much clearer picture of what’s really happening beneath the surface of the market. Each offers a unique perspective, and neither should be overlooked or abandoned, especially when the market is as noisy and unpredictable as it is right now. By keeping both approaches front and center, we can stay nimble and make more informed decisions—no matter what surprises the news cycle throws our way.

The S&P 500 continues to exhibit robust technical health, underpinned by bullish moving averages, supportive RSI readings, and a constructive MACD profile. The index is probing upper resistance levels, with Bollinger Bands and Williams %R suggesting the uptrend is intact but not yet overextended. Short-term, the market may see consolidation or minor pullbacks as it digests recent gains, especially if it approaches the psychologically significant 6,000 mark. However, as long as the SPX holds above key support levels—particularly the 50-day and 200-day moving averages—the broader upward trajectory remains credible.

Medium-term caution is warranted, as some indicators hint at a potential slowdown in momentum and the possibility of a correction if sentiment shifts or economic headwinds intensify. Nevertheless, the technical setup supports a constructive outlook, with the potential for further gains if resistance is decisively breached. Investors should remain attentive to support and resistance dynamics, as well as any shifts in momentum indicators, to navigate the current environment with confidence.

Takeaway:

The S&P 500 is on a solid upward track, with technical indicators suggesting there’s still room to climb—so settle in and enjoy the momentum, but remember to watch those important support zones along the way. Even though we might hit some bumps now and then, the overall outlook is positive, and the market’s fundamentals are keeping us cruising smoothly for now.

Announcement:

We’re excited to share some big news: our Substack is launching a brand-new section—Educational Content: Macroeconomics! This series will be led by a seasoned economics professor with deep expertise in macroeconomics and global financial markets.

This section goes beyond simply serving up textbook material—it’s about making complex ideas come alive and helping you see how they play out in the real world.

It’s about bringing macroeconomic theory to life. We want to help you connect the dots between big-picture concepts and real-world trading, so you can take what you learn here and use it to sharpen your strategies, manage risk, and ultimately build a stronger, more resilient portfolio. Think of it as your guide to turning theory into actionable insights that make a real difference in your trades.

We see this addition as a key step toward our original mission: building a community of traders and investors grounded in strong, well-rounded knowledge. We believe that understanding macroeconomics, alongside technical and fundamental analysis, creates a powerful foundation for smart investing.

We’d love to hear your thoughts and feedback—your input helps shape our community. Feel free to share your opinions or contribute ideas anytime!

OUR TRADES

Below, you will find our portfolio, which is divided into two sections: the Tactical Portfolio and the Medium-to-Long-Term Portfolio.

We share all entry and exit points of our tactical trades with our paid subscribers, along with detailed explanations for why each trade was initiated.

Tactical Portfolio

Just a quick update on our gold strategy!