Daily Newsletter 6/9/25

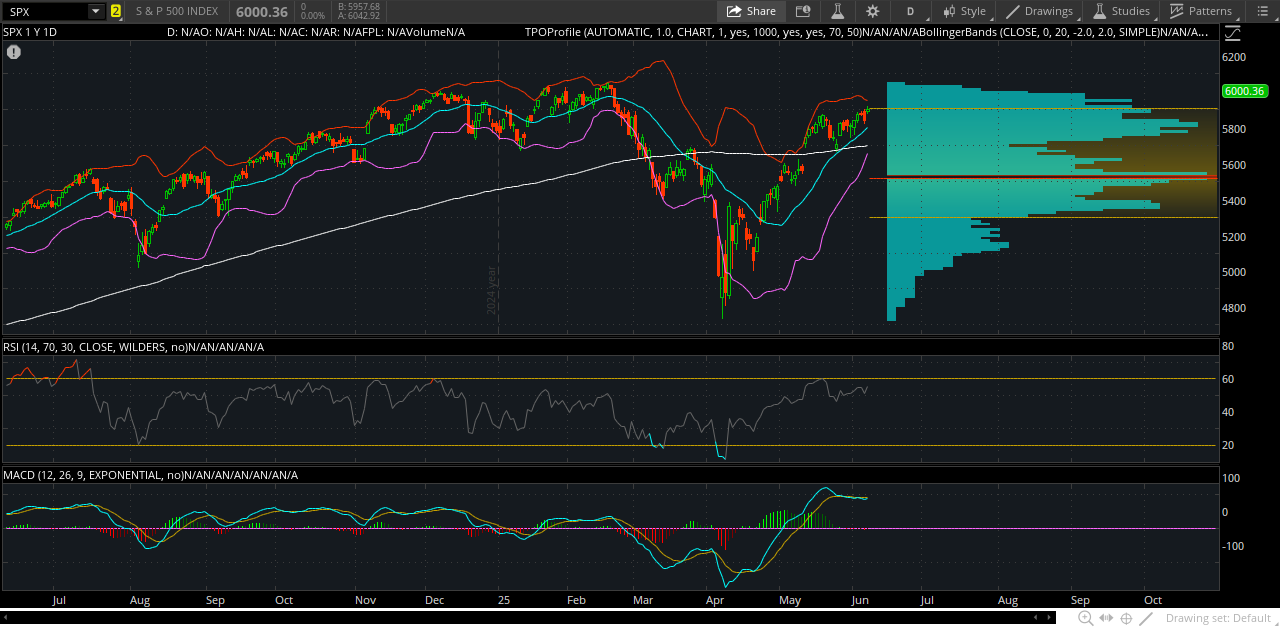

As we begin the second week of June, both Wall Street and global markets are riding a wave of cautious optimism—yet the undercurrents of uncertainty remain strong. After a strong finish last week, with the S&P 500 closing above a significant milestone for the first time since early February, investors are asking: can the rally continue, or is turbulence ahead?

Globally, sentiment is closely tied to the outcome of US-China trade negotiations. European and Asian markets are treading water as investors await clarity. The effective tariff rate has dropped after both sides signaled willingness to negotiate, but recent hikes on steel and aluminum have kept supply chain costs and inflation concerns alive.

Become a paying subscriber of MacroXX to get access to this post and other subscriber-only content.

From a technical standpoint, the S&P five hundred is moving within a narrow range, with key moving averages acting as important support levels. Market watchers are bracing for a potential “digestive period” through late June, ahead of the typical summer rally that often begins in July. With valuations stretched—trading at a high multiple of forward earnings—adding new risk exposure here may warrant caution.