DEFENSIVE STOCKS 2025

A defensive stock is a share of a company that provides consistent dividends and stable earnings regardless of the overall state of the stock market. Key characteristics of defensive stocks include:

Stability: They tend to be less affected by economic cycles compared to other stocks.

Essential goods and services: These companies typically produce necessities like food, utilities, and healthcare that remain in demand regardless of economic conditions.

Low volatility: Defensive stocks usually have a beta less than 1, meaning they are less volatile than the broader market.

Resilience during downturns: They tend to perform better than the broader market during recessions.

Consistent dividends: They often offer regular dividend payments due to stable cash flows.

Conservative financials: These companies typically have strong balance sheets with low debt levels.

Moderate returns: While they may not surge during bull markets, they also tend to fall less during bear markets.

Here are some of the top U.S. defensive stocks to consider in 2025.

Consumer Staples

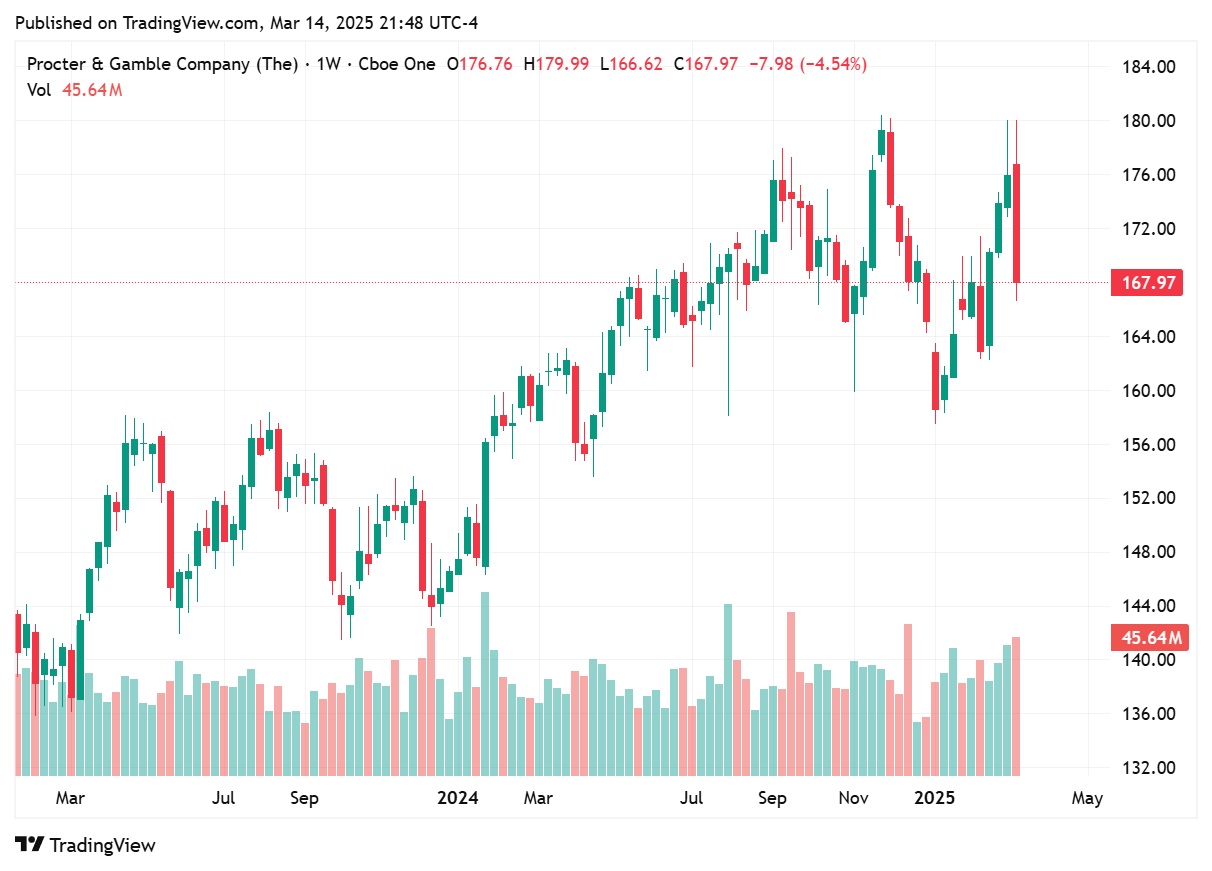

Proctor & Gamble (NYSE: PG): Offers household products with a 2.57% dividend yield

Costco (NASDAQ: COST): Operates warehouse clubs with a 0.75% dividend yield