FOMC Meeting

The Federal Open Market Committee (FOMC) announced its latest decision on March 19, 2025, at 2:00 p.m. EDT. Here are the key points from the announcement:

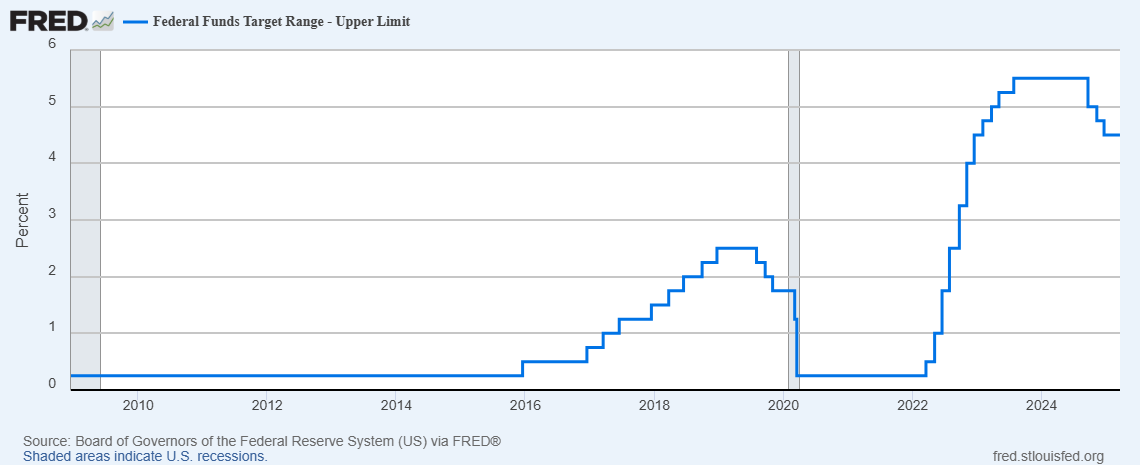

Interest rates unchanged: The FOMC decided to maintain the target range for the federal funds rate at 4-1/4 to 4-1/2 percent.

Economic outlook:The unemployment rate is projected to rise to 4.4% by year-end 2025, higher than the December forecast of 4.3%.

Inflation concerns: The Committee noted that inflation remains somewhat elevated, and they are committed to returning inflation to its 2 percent objective. Core inflation is expected to reach 2.8% in 2025, up from the previous estimate of 2.5%.

Increased uncertainty: The FOMC highlighted that uncertainty around the economic outlook has increased. The committee explicitly stated that "Uncertainty around the economic outlook has increased," emphasizing their attentiveness to risks on both sides of their dual mandate. The Federal Reserve's dual mandate refers to its two primary economic goals:

Maximum employment

Stable prices

This mandate was established by Congress in 1977 through an amendment to the Federal Reserve Act. The dual mandate guides the Fed's decision-making in conducting monetary policy to foster economic conditions that achieve both objectives.

Future rate cuts: Despite the increased uncertainty, the Fed still projects two interest rate cuts in 2025, though more officials have pulled back on their rate cut projections compared to December. Fifteen officials foresee at least one rate cut this year. The Federal Reserve maintained its projection of two rate cuts in 2025, keeping the federal funds rate forecast at 3.9% by year-end, consistent with their December outlook.