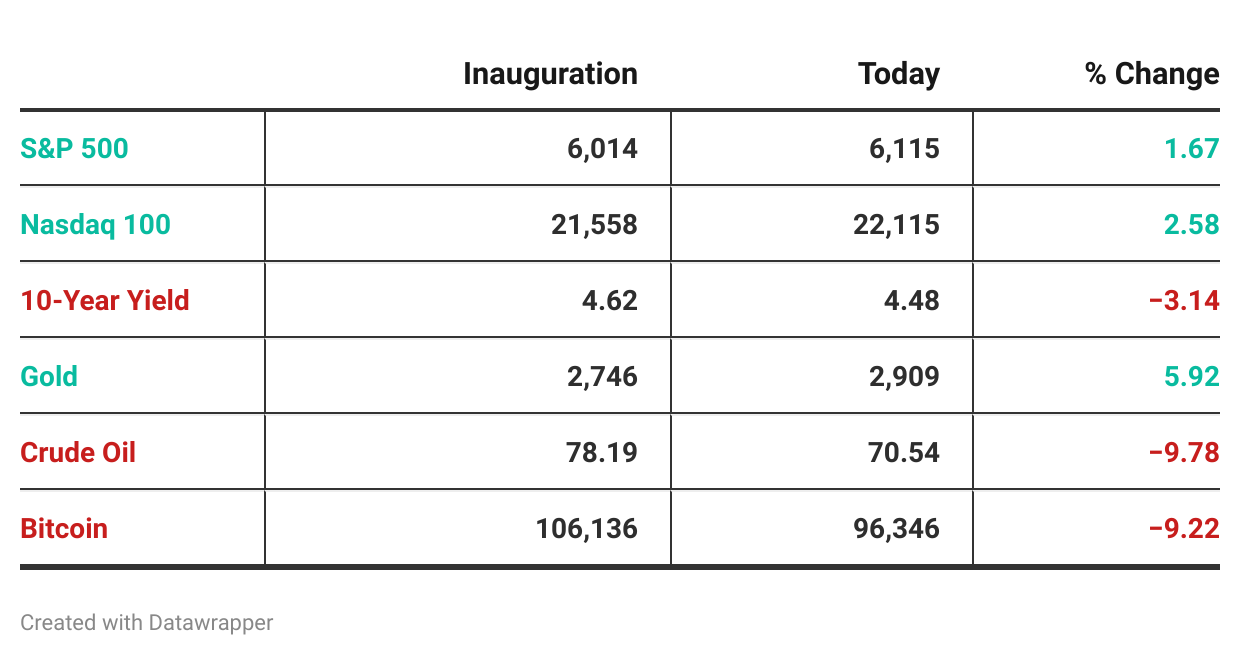

Financial markets since inauguration

Since Donald Trump's inauguration on January 20, 2025, financial markets have shown mixed but notable trends across various asset classes

.

Equity Markets

S&P 500

The S&P 500 opened at just under 6,000 points on Donald Trump's inauguration day, January 20, 2025. On February 14, 2025, the S&P 500 index closed at 6,114.63. This represents a modest increase of approximately % since the inauguration.

In the first two weeks following Trump's inauguration, the market remained essentially flat. However, on January 21, 2025, the day after the inauguration, the S&P 500 ended at its highest level since December 17, 2024. This positive movement aligns with historical trends, as the S&P 500 has typically shown gains on inauguration days. For instance, the index rose 1.39% on Joe Biden's inauguration day in 2021, marking the largest inauguration day gain since Ronald Reagan's second inauguration.

The S&P 500 has shown strong performance over the past year, with a 24.66% increase from January 2024 to January 2025. The index reached an all-time high of 6,128.18 earlier this year.

NASDAQ 100

Since the inauguration on January 20, 2025, the NASDAQ 100 has shown positive performance. On February 14, 2025, the NASDAQ 100 index closed at 22,114.69. This represents an increase of approximately 3.20% from the inauguration day closing price of 21,566.51 on January 20, 2025.

The index has continued its upward trend from 2024, which saw a strong annual return of 24.88%. In the early weeks of 2025, the NASDAQ 100 has already gained 5.25% year-to-date, indicating a robust start to the year.

It's worth noting that the NASDAQ 100 has shown some volatility in recent trading sessions, with intraday fluctuations between 22,196.2 and 22,281.8. However, the overall trend remains positive, with the index maintaining levels above its 50-day and 200-day moving averages of 21,586.824 and 20,210.871, respectively.

This performance aligns with the historical trend of the NASDAQ 100, which has shown strong returns in recent years, including a 56.42% gain in 2023 and a 25.72% increase in 2024.

Bond markets

Since Trump's inauguration on January 20, 2025, the bond market has shown some notable movements:

On the first full trading day after the inauguration, Treasury yields decreased to their lows of the year as government bonds rallied. This initial rally was attributed to relief over the lack of immediate sweeping announcements on trade tariffs.

However, as of February 17, 2025, the 10-year Treasury yield stands at approximately 4.65%, which is about 100 basis points higher than it was in September 2024. This increase suggests that bond prices have fallen since then, as yields move inversely to prices.

The bond market appears to be pricing in potential inflationary pressures due to Trump's policies. Experts expect that Trump's economic agenda may raise inflation fears in the bond market.

Despite these concerns, yields are still considered to be in line with historical averages and consistent with the Federal Reserve's inflation goals.

The Federal Reserve is preparing to navigate what could be a rocky bond market under the Trump administration, after two years of relatively smooth sailing.

1. Daily Newsletter Mo-Fr before 9:30 a.m. EST. Deliver timely updates on market trends.

2. Daily Analysis Daily analysis of financial markets involves discussing important daily events that can impact various asset classes Mo-Fr Twice daily

3. Weekly Snapshot provides a overview of market activity, allowing investors, traders, and analysts to assess the state of various financial markets. Sundays

4. Monthly Deepdive Comprehensive analysis of key economic indicators