Index of Consumer Sentiment

How does the declining Index of Consumer Sentiment impact the broader economy and stock market performance?

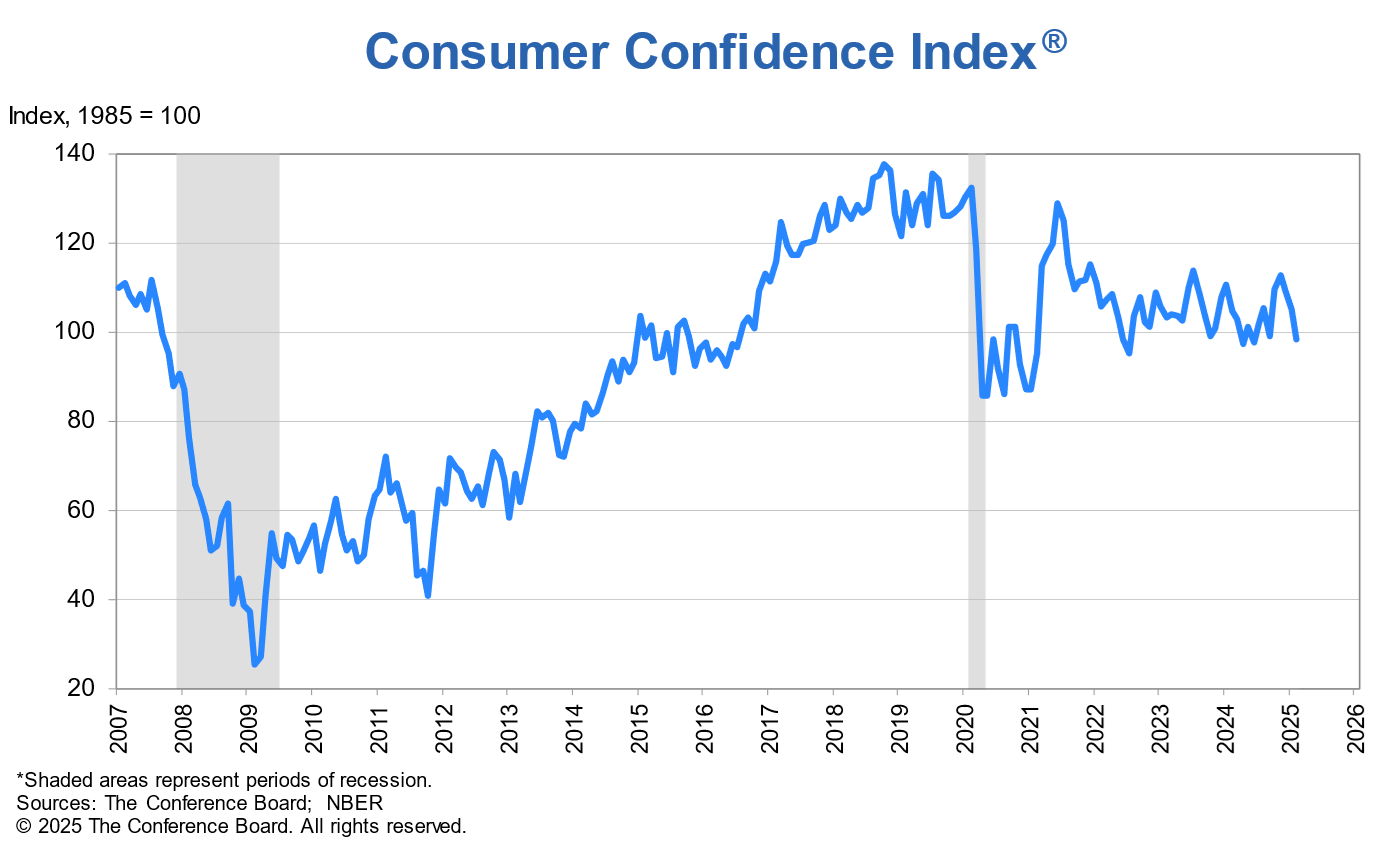

The latest Index of Consumer Sentiment, as measured by the Conference Board's Consumer Confidence Index, has declined sharply in February 2025, marking the most significant drop in over three years.

The index fell to 98.3 in February from 105.3 in January, a 7-point drop.

This decline represents the largest monthly decrease since August 2021.

The drop was more severe than economists expected, with forecasts projecting a reading of 102.5 to 103.

The Index of Consumer Sentiment (ICS) is a key economic indicator that measures consumer attitudes and expectations about the economy and their personal finances. The Conference Board Consumer Confidence Index was created by The Conference Board in 1967. Initially, it was conducted as a mail survey every two months. In June 1977, the Consumer Confidence Survey (CCS) began monthly collection and publication. The index has maintained consistent concepts, definitions, and questions since its inception, making it a long-standing and reliable measure of consumer sentiment in the United States. It provides insights into future consumer spending behavior and overall economic health.

While there is no perfect correlation between the Index of Consumer Sentiment and stock market performance, there is a relationship between the two that investors and economists often consider.

There is a moderate positive correlation between the ICS and the S&P 500, with studies showing correlation coefficients ranging from 0.30 to 0.67.

The strongest correlation is observed between current monthly changes in the Consumer Sentiment index and the previous monthly change in the S&P 500 index, indicating that the stock market's performance tends to influence consumer sentiment in the following month.

The correlation increases from 0.61 to 0.67 when considering a five-day lag between the S&P 500 and consumer confidence, suggesting that changes in the stock market take a few days to fully impact consumer sentiment.

Therefore, the declining Index of Consumer Sentiment (ICS) does warrant some concern,however it is important to know which one is the dependent variable and which one is the independent variable.

Based on the research findings, the stock market appears to be the independent factor in its relationship with consumer sentiment.

It is important to note that consumer sentiment can influence stock market performance in several ways:

Consumer spending: Higher consumer sentiment often leads to increased consumer spending, which can boost corporate profits and potentially drive stock prices higher.

Economic indicator: The Index of Consumer Sentiment is viewed as a leading indicator of economic health. A positive outlook can contribute to investor confidence and potentially support stock market gains.

Market volatility: Significant changes in consumer sentiment can impact market volatility. For example, a sharp decline in sentiment can contribute to increased market turbulence, as seen in February 2025 when the S&P 500 and Dow Jones each fell 1.7% following a drop in consumer sentiment.

ICS and Stock Market Performance

The declining Index of Consumer Sentiment indicates growing concerns about the health of the U.S. economy. However, it is important to note that studies have found that stock returns and changes in consumer confidence are positively correlated, with stock prices Granger-causing consumer confidence, but not vice versa.

Based on the research findings, the stock market appears to be the independent factor in its relationship with consumer sentiment. Several key points support this conclusion:

1. Granger-causality tests indicate that stock prices affect consumer confidence, but consumer confidence does not affect stock prices.