Long-Term Budget Outlook: 2025 to 2055

The Congessional Budget Office

The Congressional Budget Office (CBO) is set to release its Long-Term Budget Outlook: 2025 to 2055 on Thursday, March 27, 2025, at 2 p.m. EDT. This report will provide updated projections on the federal budget and economic trends over the next three decades. The Congressional Budget Office (CBO) is a nonpartisan federal agency that provides budget and economic information to Congress. The CBO employs approximately 250 people, including economists and policy analysts who produce reports and cost estimates to support the Congressional budget process.

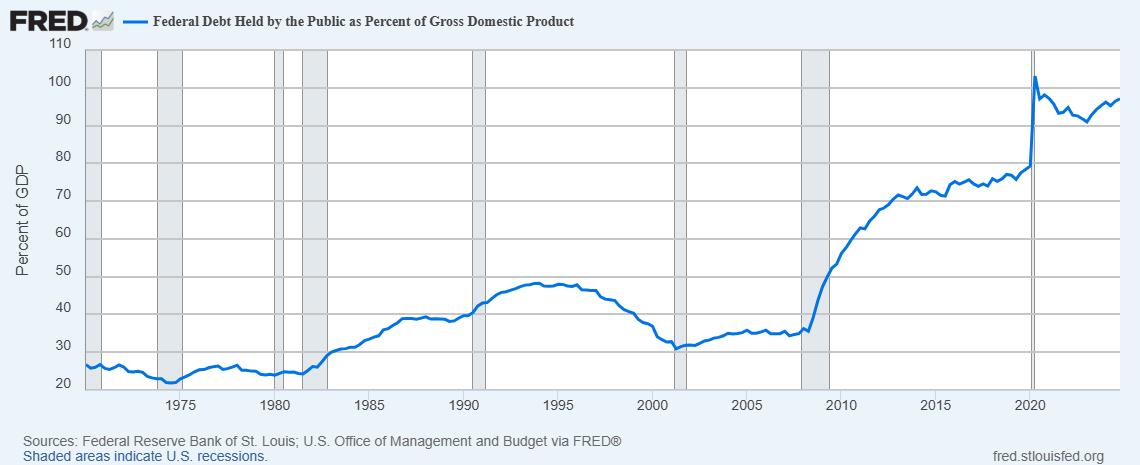

Based on available projections and analyses, the fiscal outlook for the United States over this period appears challenging and unsustainable.

Key Projections

Debt-to-GDP Ratio: The federal debt held by the public is projected to rise from 100% of GDP in 2025 to 118% by 2035, and further increase to 154% by 2055. This would be higher than any point in U.S. history.

Budget Deficits: The federal budget deficit is expected to grow from $1.9 trillion in 2025 to $2.7 trillion by 2035. By 2055, the unified deficit is projected to reach 7.0% of GDP.

The main drivers behind the projected deficits from 2025 to 2055 are:

Persistent Primary Deficits: Federal non-interest spending and revenues are projected to remain out of balance, generating sizable primary deficits even under near-full-employment assumptions.

Rising Interest Payments: Net interest payments are expected to increase substantially, from 3.1% of GDP in 2025 to 4.1% in 2035, and further to 5.4% by 2055. This is due to high pre-existing debt, persistent primary deficits, and gradually increasing interest rates.

Demographic Shifts: An aging population is expected to reduce the number of working-age individuals, dampening economic growth and increasing pressure on age-related programs such as Social Security and Medicare.

Slower Economic Growth: The average annual real GDP growth is projected to be lower (1.7% to 1.8%) from 2016 to 2055, compared to the 2.8% average between 1970 and 2015.

Revenue-Spending Imbalance: While revenues are projected to rise from 17.1% of GDP in 2025 to 19.3% in 2055, non-interest spending is expected to increase from 20.2% of GDP in 2025 to 21.0% in 2055, maintaining a gap between income and expenditures.

Interest Rate Dynamics: The average nominal interest rate on government debt is projected to exceed the nominal economic growth rate starting in 2046, potentially leading to explosive debt dynamics.