PCE vs. CPI

How to interpret the inflation data?

PCE release 2/28/25

The next Personal Consumption Expenditures (PCE) Price Index release is scheduled for February 28, 2025. This release will provide updated inflation data for January 2025. The PCE Price Index is the Federal Reserve's preferred measure of inflation and includes both the headline PCE index and the core PCE index (which excludes food and energy prices).

Key points about the upcoming release:

Date: February 28, 2025

Time: Typically released at 8:30 AM Eastern Time

Data covered: January 2025 inflation figures

Importance: Closely watched by the Federal Reserve and financial markets for insights into inflation trends.

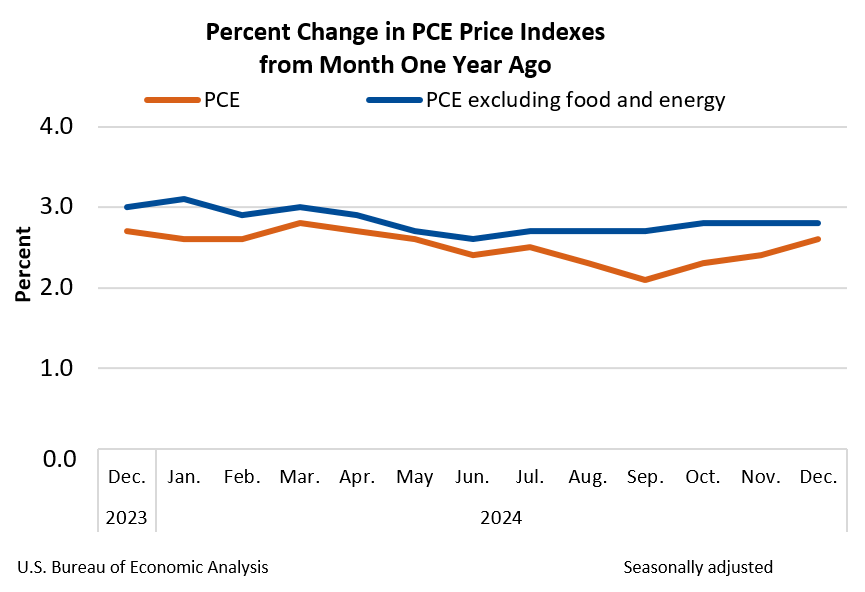

The previous PCE release was on January 31, 2025, which covered data for December 2024. The most recent data showed:

Headline PCE Price Index annual change: 2.6%

Core PCE Price Index annual change: 2.8%

These figures will be updated with the upcoming release, providing fresh insights into the state of inflation in the U.S. economy.

To interpret inflation data effectively, it is important to know that the Federal Reserve prefers the Personal Consumption Expenditures (PCE) Price Index as its primary measure of inflation. This preference has several key implications:

Comprehensive coverage: The PCE includes a broader range of goods and services compared to the CPI, providing a more complete picture of consumer spending patterns.

Accuracy: The Fed considers the PCE to be a more accurate representation of consumer inflation than the Consumer Price Index (CPI).

Policy decisions: The Federal Open Market Committee (FOMC) uses PCE inflation in its quarterly economic projections and states its longer-run inflation goal in terms of headline PCE.

Flexibility: The PCE can account for changes in consumer behavior, such as substituting cheaper alternatives when prices rise, which the CPI does not capture as effectively.

Target rate: The Fed's inflation target of 2% annually is based on the PCE measure.

Core PCE focus: While the Fed tracks both headline and core PCE, it often pays closer attention to core PCE (excluding food and energy prices) for long-term inflation trends.

Monetary policy: The Fed's interest rate decisions are influenced by PCE data, as seen in recent policy statements and market reactions to PCE releases.

PCE vs. CPI

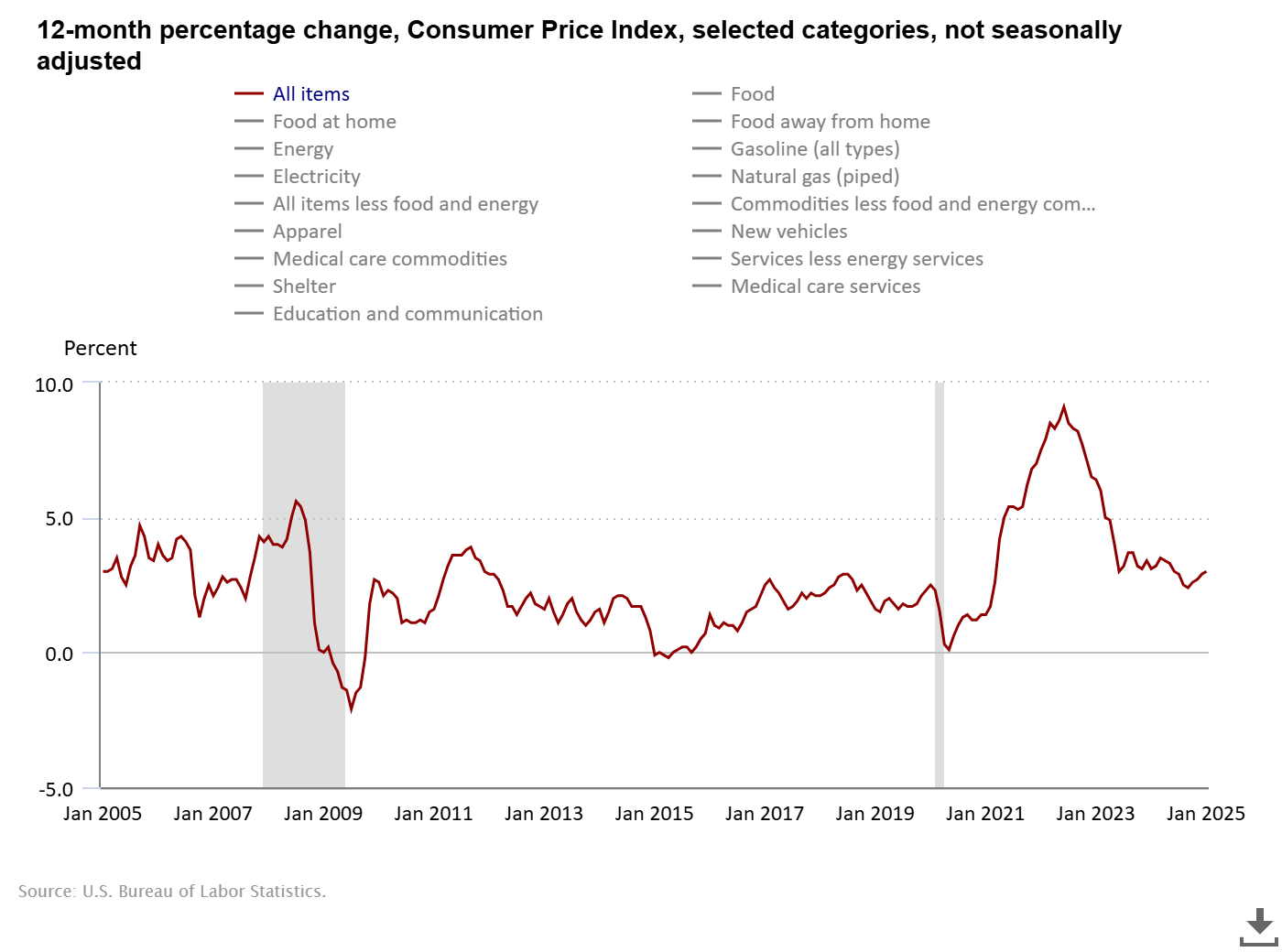

The Personal Consumption Expenditures (PCE) Price Index and the Consumer Price Index (CPI) are both measures of inflation in the United States, but they differ in several key aspects of their methodology.

Understanding the Measures

Consumer Price Index (CPI): The CPI measures the average change in prices paid by urban consumers for a representative basket of goods and services over time. It's expressed as an index value, with the base period (usually 1982-84) set to 100.

Personal Consumption Expenditures (PCE) Price Index: While not mentioned in the search results, this is another important inflation measure preferred by the Federal Reserve.

Scope and Coverage

Population: The CPI covers only urban consumers, while the PCE includes both urban and rural populations.

Expenditures: The CPI focuses on out-of-pocket consumer spending, whereas the PCE includes all goods and services purchased on behalf of consumers, including those paid for by employers or the government.

Medical care: The CPI only tracks out-of-pocket consumer medical expenditures, while the PCE also includes expenditures made for consumers, such as those covered by employers and government programs.

Formula and Weighting

Index formula: The CPI uses a Laspeyres-type index formula, which holds item weights constant. In contrast, the PCE employs a Fisher Ideal index formula, allowing weights to fluctuate based on consumer behavior.