Stock market performance when the VIX is above 45

S&P 500 when VIX > 45

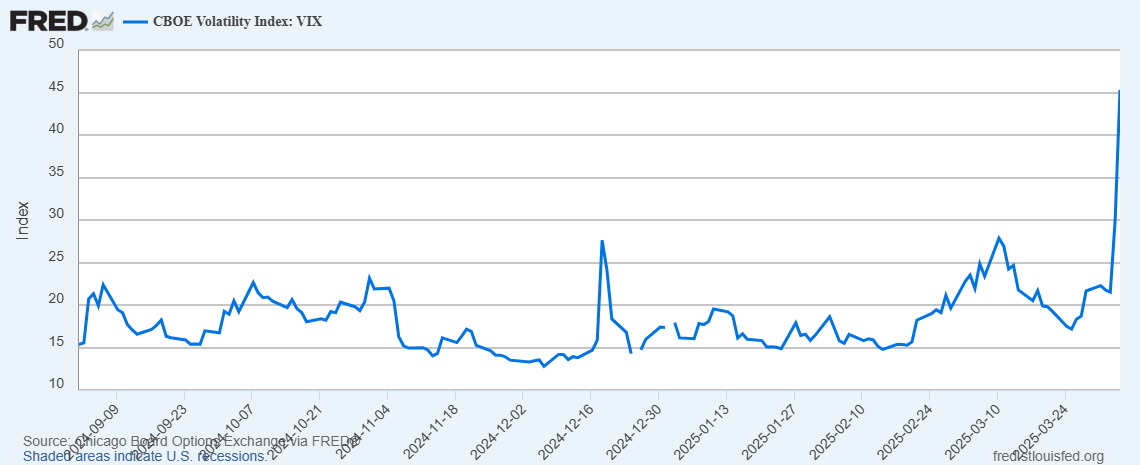

Financial markets have recently experienced a significant surge in volatility.

The VIX, or the CBOE Volatility Index, is a real-time market index that measures the 30-day expected volatility of the U.S. stock market, specifically derived from the prices of S&P 500 options. Often referred to as the "fear index" or "fear gauge," it reflects market uncertainty and investor sentiment about future price fluctuations

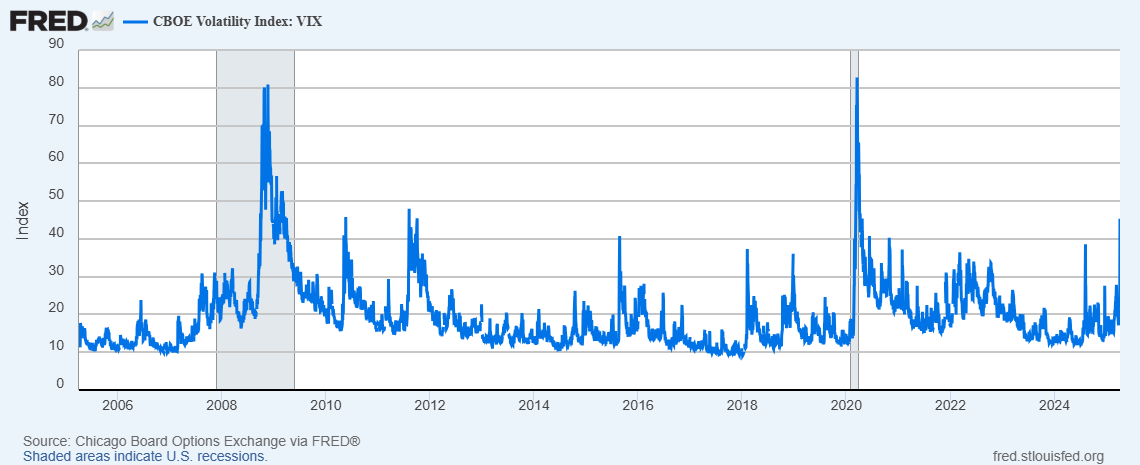

In this post, we examine how the S&P 500 performed over a two-month period following each instance when the VIX surpassed 45, beginning in 2010.

S&P 500 when VIX > 45

The VIX level of 45 is significant because it indicates a period of extreme market volatility and heightened investor fear. Historically, when the VIX surpasses 45, it often correlates with major market stress, such as sharp declines in stock prices or broader economic uncertainty.