U.S. Trade Deficit

Is it good or bad?

The US trade deficit hit a record high of $131.4 billion in January 2025, marking a significant 34% increase from the revised December 2024 figure of $98.1 billion. This surge in the trade gap was primarily driven by a substantial increase in imports, which rose by 10% to $401.2 billion, the highest increase since July 2020.

What is Trade in Goods and Services?

Monthly trade between U.S. residents and those from other countries involves the exchange of goods and services. Sales made by U.S. entities to foreign buyers are considered exports, while purchases made by U.S. entities from foreign sellers are imports. The trade balance is calculated by subtracting the total value of imports from the total value of exports.

Monthly

Several factors contributed to this record deficit:

Tariff anticipation: Companies rushed to secure goods from overseas before President Donald Trump imposed new tariffs on major trading partners.

Import surge: Imports of goods rose by a record 12.3% to $329.5 billion, with notable increases in:

Industrial supplies and materials ($23.1 billion increase)

Consumer goods ($6.0 billion increase)

Capital goods ($4.6 billion increase)

Imports of services increased $0.4 billion to $71.7 billion.

Export decline: While imports surged, exports declined by 2.6% to $266.5 billion, mainly due to decreases in pharmaceutical preparations, crude oil, and computers.

The widening trade deficit has potential implications for the US economy and currency:

Economic growth: The expanding trade gap might hinder economic growth in the first quarter of 2025.

Currency pressure: A higher trade deficit could put downward pressure on the value of the US dollar.

However, it's important to note that a larger trade deficit isn't always negative for the overall economy. It can reflect increased consumer spending, which drives economic growth, and may indicate robust consumer demand for imported goods.

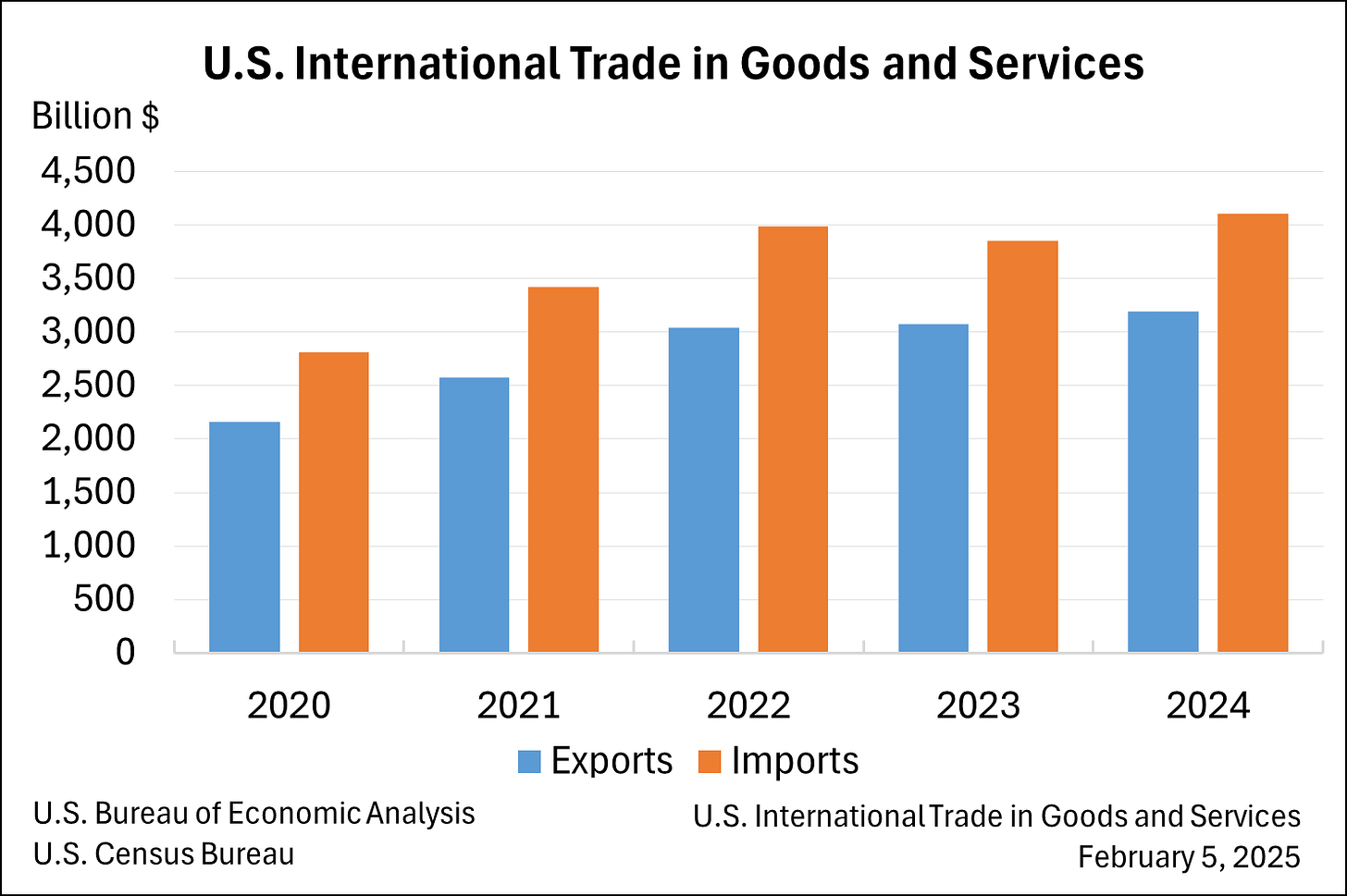

Annual

For the full year 2024, the US trade deficit increased by 17% from 2023, reaching $918.4 billion. The largest trade gaps were recorded with China ($295.4 billion), the European Union ($235.6 billion), Mexico ($171.8 billion), and Vietnam ($123.5 billion).

Why does the trade deficit matter?

The trade deficit matters for several reasons, though its implications are complex and not universally negative:

Economic Growth: The trade deficit can influence economic growth. While a larger deficit might suggest robust consumer demand for imported goods, it can also potentially hinder economic growth in the short term. This widening trade deficit is expected to negatively impact GDP growth in the first quarter of 2025

Economic Indicator: The trade deficit serves as an important economic indicator, reflecting the balance between a nation's imports and exports. A widening deficit, like the recent record high of $131.4 billion in January 2025, indicates that the U.S. is importing significantly more goods and services than it's exporting.

Currency Impact: A larger trade deficit can put downward pressure on the value of the U.S. dollar. This occurs because more U.S. dollars are leaving the country to purchase foreign-made goods, potentially weakening the currency's value in international markets.

Global Economic Relationships: