Valuation of Magnificent 7

Overvalued?

The valuation of the Magnificent 7 stocks (Alphabet, Amazon, Apple, Meta, Microsoft, Nvidia, and Tesla) is a subject of debate among analysts and investors. While some consider them overvalued, others argue they are reasonably priced or even undervalued relative to the broader market.

The valuation of the Magnificent 7 remains a complex issue. While their absolute valuations appear high, their strong performance and market dominance have led some analysts to argue that they are justified. However, the sustainability of their growth and the potential for increased competition and regulatory scrutiny could impact their future valuations.

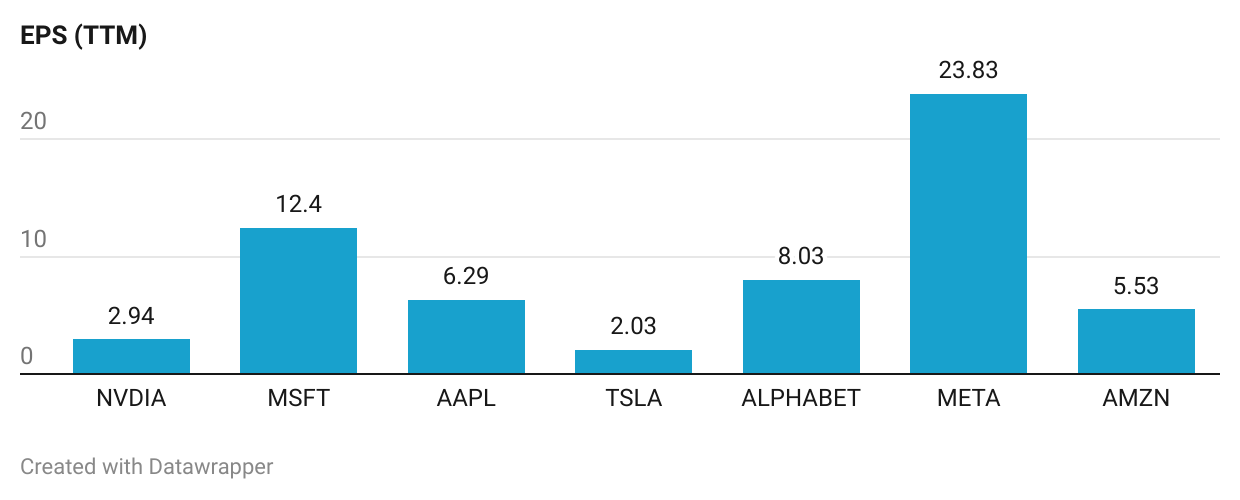

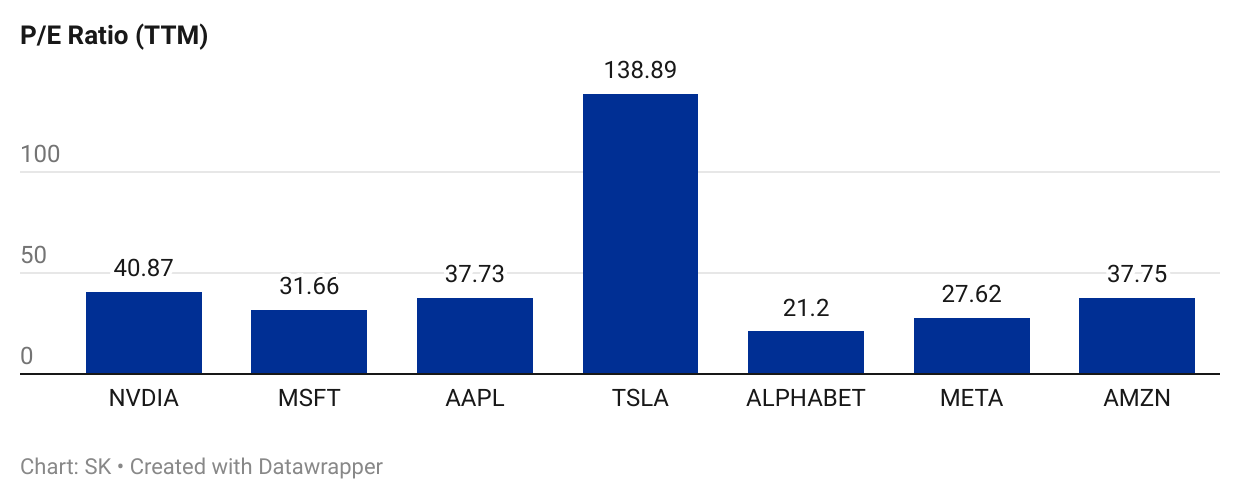

This analysis will focus on two crucial financial metrics—Earnings Per Share (EPS) and Price-to-Earnings (P/E) Ratio—to assess the potential overvaluation of the Magnificent 7 stocks.

EPS

EPS, or Earnings Per Share, is a financial ratio that measures a company's profitability on a per-share basis. It is calculated by dividing a company's net income (minus preferred dividends) by the number of outstanding common shares.

There is no fixed value that universally defines a "high" EPS, as it depends on various factors such as the company's industry, size, and growth stage.

P/E Ratio

The Price-to-Earnings (P/E) ratio is a key valuation metric used by investors to assess a company's stock value relative to its earnings. It is calculated by dividing a company's current stock price by its earnings per share (EPS).

There is a general consensus among most investors that a P/E ratio of around 20 is 'fairly valued'.