Week 14 (March 31-April 6, 2025)

Dear readers,

This week's most significant event was undoubtedly President Trump's announcement of tariffs, which had a profound impact on global trade dynamics.

President Donald Trump announced "Liberation Day" on April 2, 2025, starting with a post on his Truth Social platform at 7:06 a.m. EST. He officially unveiled the plan during a 4 p.m. event in the White House Rose Garden titled "Make America Wealthy Again," where he introduced sweeping reciprocal tariffs aimed at reshaping global trade dynamics.

By Friday, we had gained clarity on the upper limit. President Trump set the ceiling for tariffs at 24%, far exceeding the consensus expectation of 10%.

Global reactions to President Trump's sweeping tariffs were diverse, ranging from sharp criticism and threats of retaliation to calls for negotiation.

China, hit with a 34% tariff on top of existing 20% duties, condemned the measures as a violation of WTO rules and an act of unilateral bullying. It vowed to implement "determined countermeasures" to protect its interests.

The EU and UK have decided against immediate retaliation, hoping to persuade President Trump to soften the measures.

EU chief Ursula von der Leyen called the tariffs a "major blow to the world economy" and warned of "spiraling uncertainty" with serious repercussions for millions globally.

The EU, facing a 20% tariff, pledged collective action and prepared countermeasures if negotiations fail. Leaders like France's Emmanuel Macron and Poland's Donald Tusk criticized the decision but emphasized the importance of maintaining U.S.-EU relations.

India faces a 26% blanket tariff, which is expected to hurt labor-intensive exports and GDP growth. However, India's pharmaceutical sector remains unaffected as medicines are exempt. India has adopted a conciliatory approach, seeking bilateral trade agreements.

Brazil passed a reciprocity bill allowing retaliation and is considering appealing to the WTO over steel tariffs. Colombia took a nuanced stance, viewing the tariffs as an opportunity for agro-industrial exports while warning against raising tariffs unnecessarily.

South Africa denounced the tariffs as "punitive," warning they could disrupt trade and prosperity. Other African nations like Kenya and Madagascar face steep tariffs, compounding challenges from reduced U.S. aid.

Oil prices plummeted due to fears of a global economic slowdown.

FED

In his speech on April 4, 2025, Federal Reserve Chair Jerome Powell addressed the economic outlook amidst President Trump's sweeping tariff policies. Key points from Powell's remarks include:

Inflation and Growth Concerns

Powell warned that the tariffs are likely to increase inflation and slow economic growth. He stated that while inflation effects might initially be temporary, they could become more persistent depending on the scope and duration of the tariffs. He described the economic outlook as "highly uncertain," with risks of elevated prices and diminished growth due to trade policy changes.

Monetary Policy Approach

Powell emphasized that it is premature for the Fed to determine the appropriate monetary policy response. The central bank plans to wait for more clarity before making adjustments to interest rates. He highlighted the Fed's dual mandate of maintaining price stability and full employment, noting potential conflicts between these objectives if inflation rises while growth slows.

Current Economic Conditions

Despite escalating trade tensions, Powell noted that the economy remains in a "good place," supported by a strong labor market and solid growth indicators. However, he acknowledged growing concerns among households and businesses, as surveys report dimming expectations due to uncertainty surrounding new trade policies.

Political Independence

Powell reaffirmed the Fed’s commitment to remaining apolitical, declining to respond directly to President Trump's public calls for interest rate cuts.

In summary, Powell's speech highlighted the challenges posed by Trump's tariffs, including inflationary pressures and potential economic slowdown, while signaling that the Fed would adopt a cautious approach in responding to these developments.

Indices

Dow Jones Industrial Average:

Lost over 4,000 points across two days, a total decline of 9.48%.

Fell 1,679 points (-3.98%) on April 3 and 2,231 points (-5.50%) on April 4.

S&P 500:

The S&P 500 fell by 10.5% over Thursday and Friday, marking its worst two-day drop since the COVID-19 pandemic in 2020. Futures for the index dropped an additional 4% on Sunday evening

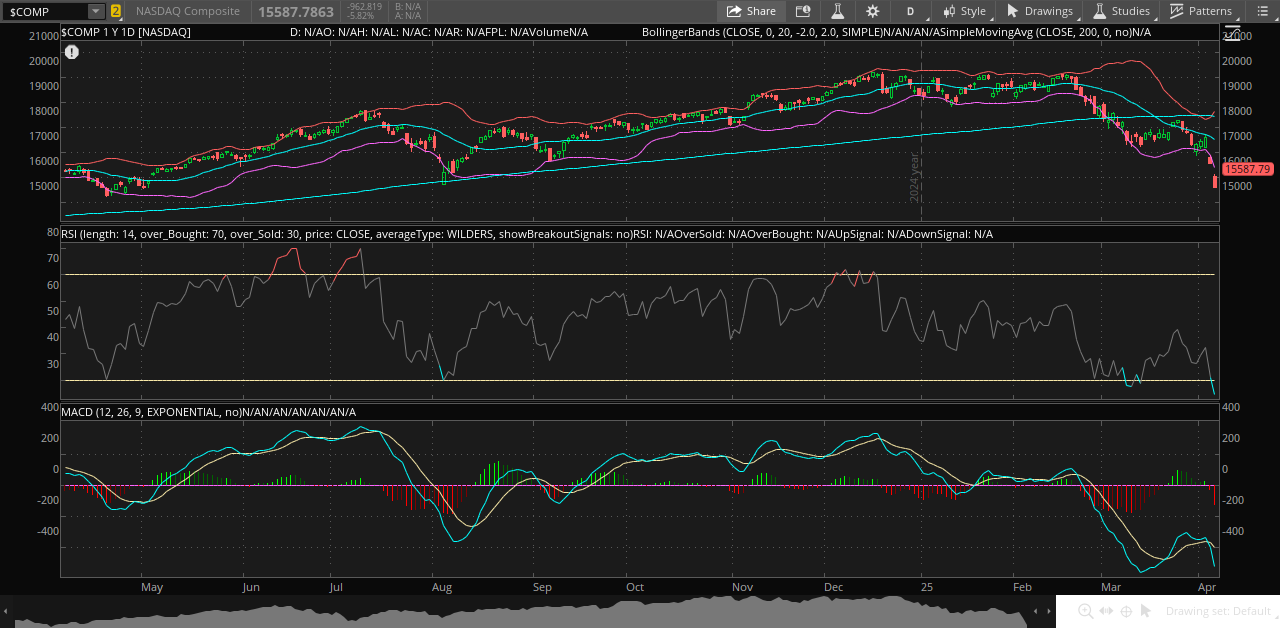

Nasdaq Composite:

The Nasdaq Composite entered bear market territory, down over 23% from its December peak.

Jobs report

The U.S. jobs report, officially known as the Employment Situation Summary, is released by the Bureau of Labor Statistics (BLS) on a monthly basis. Typically, it is published on the first Friday of every month at 8:30 a.m. EST, unless there is a holiday or other reason to adjust the date. This report provides comprehensive data on employment, unemployment rates, and other labor market indicators, serving as a key economic indicator for assessing the health of the U.S. economy.

In March 2025, the U.S. economy added 228,000 nonfarm payroll jobs, according to the Bureau of Labor Statistics. This exceeded the average monthly gain of 158,000 over the prior 12 months and surpassed consensus expectations of 140,000. The unemployment rate ticked up slightly to 4.2% from 4.1% in February. The March report indicates stronger-than-expected job growth concentrated in specific sectors like health care and transportation. However, downward revisions for previous months highlight some softness in earlier employment data. Persistent macroeconomic challenges such as trade policy shifts and elevated interest rates could pose headwinds for future hiring.

OUR TRADES

We plan to update our tactical positions tomorrow after the market opens. However, to share our portfolio along with our entry and exit strategies, we need to review the pre-market activity first.

We will share all updates regarding our portfolio in our daily newsletter, which you will receive in your email inbox before the 9:30 a.m. EST market open.

We provide our weekly summary at no cost. However, if you're interested in accessing our specific entry and exit points, along with real-time trade updates, and gain access to expert insights on macroeconomics and finance, please consider upgrading to a paid subscription. A paid subscription will also grant you access to insights on how we structure our advanced options trades.

The information provided in this newsletter is for informational purposes only and should not be taken as financial advice. This information is provided solely for general information and educational purposes. It is not, and should not be construed as, an offer to buy or sell, or as a solicitation of an offer to buy or sell financial instruments. The authors do not assume any responsibility for any losses or damages arising from using the information provided in this newsletter. Any investments or decisions made based on the information provided in this newsletter are the reader's sole responsibility.