Week 16 (April 14-April 20, 2025)

Markets remained volatile, with the U.S. dollar, stocks, and bonds all under pressure due to policy uncertainty and shifting global alliances.

The US-China trade war has sharply escalated, with both sides imposing record-high tariffs and employing new economic weapons.

Government’s plan: Anticipate an initial surge in inflation, but should a recession develop, the Federal Reserve is likely to respond by lowering interest rates. This would help bring inflation down and could set off a rally in the bond market as well as support a recovery in housing. Tax cuts are expected to stimulate the economic rebound, while spending reductions may further strengthen bond prices.

We find this scenario theoretically attractive but overly complex. There is minimal focus on safeguarding U.S. supply chains, and the broader ripple and feedback effects are not being taken into account.

Weeks ago, we shifted to a recession-based scenario ahead of both Goldman Sachs and the broader consensus.

Given the current environment of poor liquidity, we would not be surprised to see the Treasury and the Federal Reserve step in to support Treasury bonds. Such intervention would likely prompt a market rally.

Investors are closely watching upcoming inflation data, central bank decisions, and further developments in U.S. trade and monetary policy for direction in the weeks ahead.

This week (Week 16), we successfully executed all our tactical trades, making it a particularly strong period for our portfolio. While there was potential to open additional positions, implement more complex options strategies, and further reduce our cash holdings, the heightened market uncertainty prompted us to maintain a cautious approach and prioritize careful hedging.

Next week (Week 17), we will closely monitor earnings releases, as they will play a crucial role in shaping the direction of the US economy.

Market volatility may also be driven by ongoing earnings reports and any unexpected developments in global trade or central bank commentary.

VIX

The VIX remains elevated at approximately 32, though this is lower than the levels seen in recent days.

The VIX typically averages between 15 and 20 during periods of market stability.

The VIX Index measures the market’s expectation of 30-day volatility for the U.S. stock market, calculated in real time from mid-quote prices of S&P 500 Index call and put options. It is globally recognized as a key gauge of market volatility, widely reported by financial media and closely watched by investors and analysts as a daily indicator of market sentiment.

DXY

The DXY has dropped sharply to multi-year lows as concerns over Federal Reserve independence and aggressive trade policies under President Trump have shaken investor confidence in the US dollar.

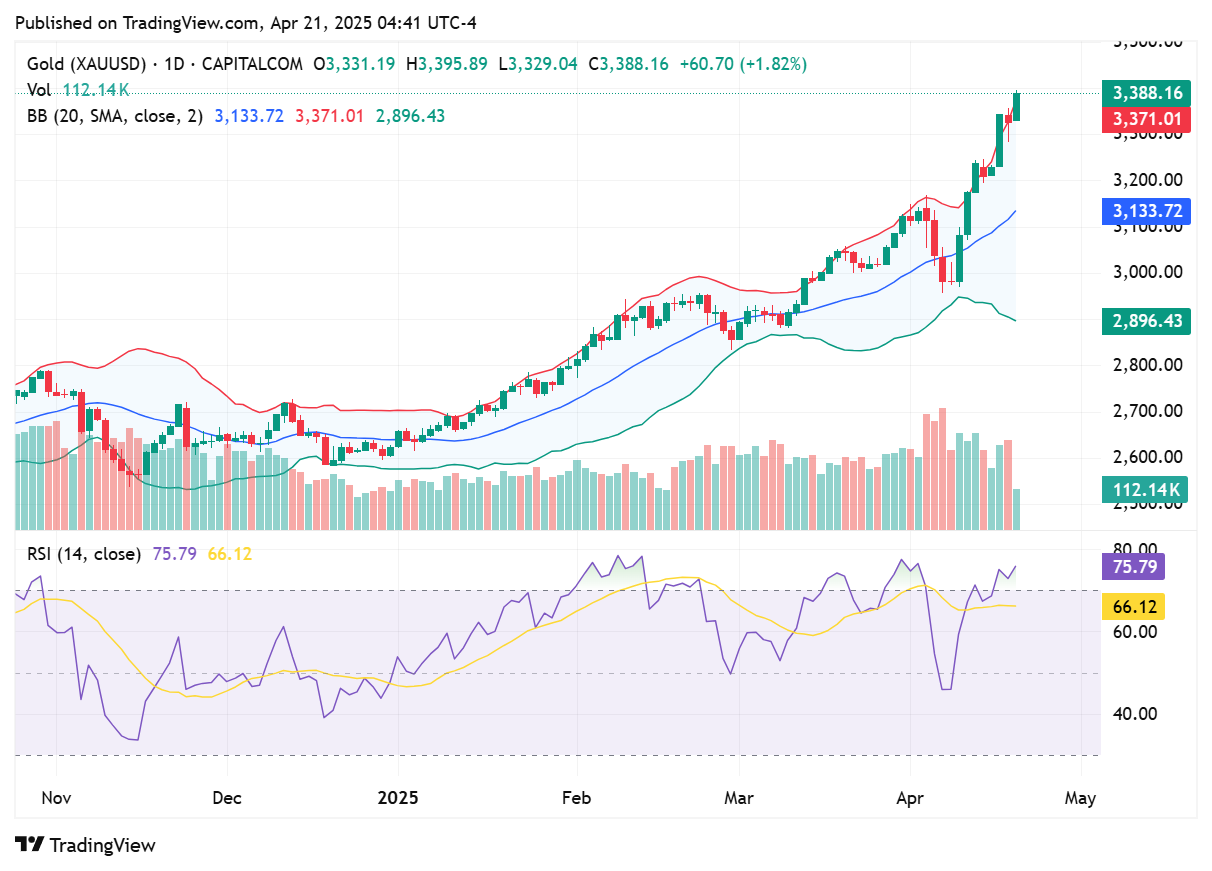

GOLD

Gold reached an all-time high above $3,400 per ounce on April 21, 2025, marking a 29% increase since the start of the year.

The sharp rally is largely attributed to escalating U.S.-China trade disputes and the imposition of new tariffs by President Donald Trump, which have heightened global economic uncertainty.

Persistent concerns over inflation, recession risks, and geopolitical instability have driven investors toward gold as a hedge.

OIL

Brent Crude: $66.99 per barrel

WTI Crude: $63.27 per barrel

Recent Trend: Both benchmarks have fallen over 11% since the start of 2025

OPEC+ is set to increase output by 411,000 barrels per day in May, reinforcing concerns about oversupply. Compliance issues and overproduction by some members add to the uncertainty.

The U.S. Energy Information Administration (EIA) now projects Brent crude to average $67.87 per barrel in 2025, a downward revision due to expectations of rising global inventories and slower demand growth.

Analysts expect continued price volatility as markets react to evolving trade policies, OPEC+ production decisions, and geopolitical developments.

FED

Donald Trump's statement on Thursday asserting his authority to dismiss Jerome Powell added to market uncertainty.

The Federal Reserve's independence means it can set monetary policy—primarily interest rates—without direct interference from the White House or Congress, even if political leaders disagree with its decisions. This autonomy is widely regarded by economists and investors as essential for achieving stable prices, maximum employment, and overall economic stability.

Simply granting the president the authority to dismiss the Fed chair would unsettle investors and erode confidence in U.S. financial markets.

OUR TRADES

This week, we made several adjustments to our portfolio to capitalize on market uncertainty, implementing tactical trades as needed.