Week 19 (May 5-May 11, 2025)

The most consequential economic development last week was the agreement reached between the United States and China in Geneva to significantly reduce tariffs and ease their ongoing trade dispute, which had been causing major disruptions to global supply chains and financial markets in recent months. The United States will reduce the additional tariffs from 145% to 30%, while China will lower its retaliatory duties on U.S. imports, introduced since April 2, from 125% to 10%.

The main benefit of this agreement is that it averts the immediate danger of a stagflationary shock to the US economy.

The details of the agreement remain limited and many aspects are still uncertain. Officials from both sides have described the talks as constructive and highlighted substantial progress, but the official statements released so far lack specifics about implementation and long-term commitments.

However, the deal is temporary, and significant uncertainty remains as both sides work toward a more comprehensive resolution.

While the deal is an encouraging development, lasting progress will depend on follow-through and the outcomes of future negotiations.

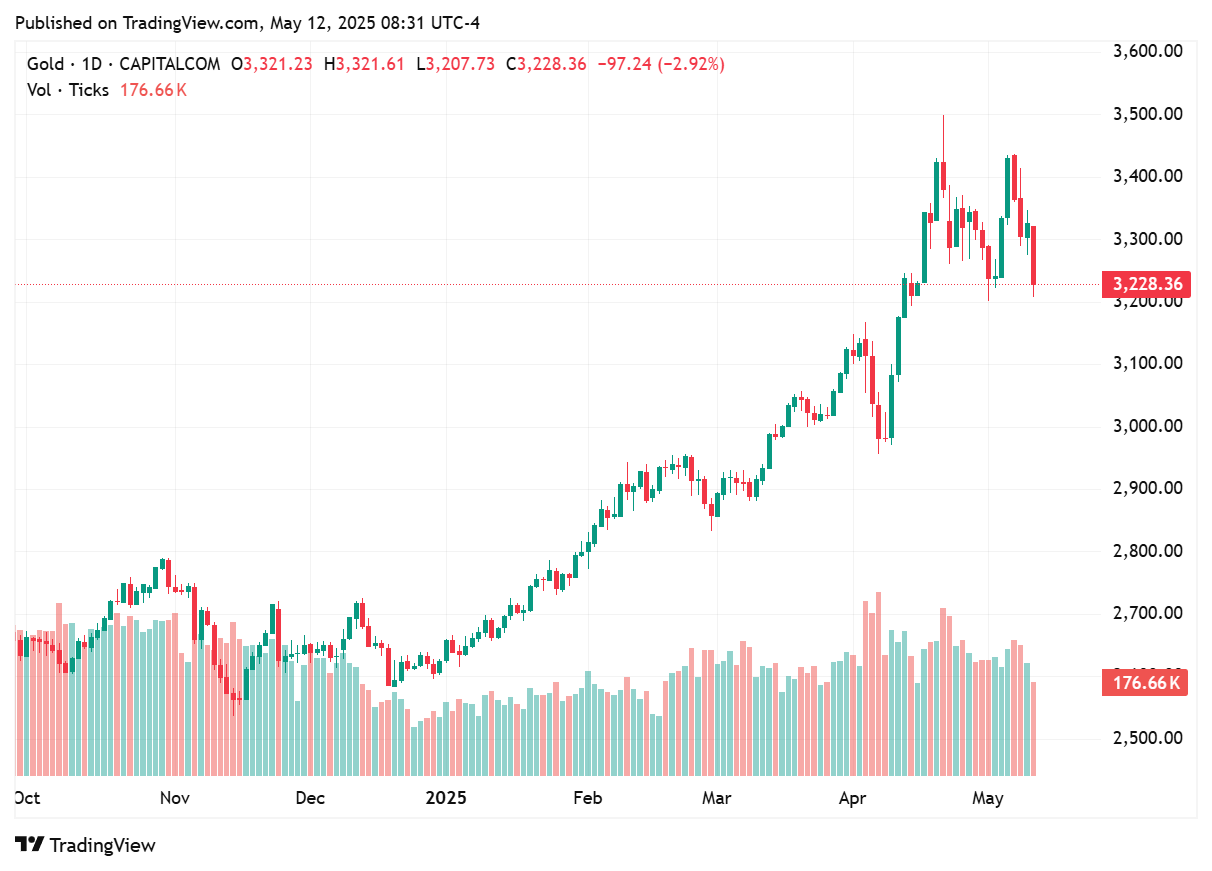

U.S. assets-including equities and the dollar-climbed sharply, Treasury yields increased, and gold prices declined, signaling renewed investor optimism and a shift toward a risk-on sentiment in the markets.

We believe that in order to share the market's enthusiasm, it is important to observe how the markets gradually absorb and respond to this new information.

The U.S. and the U.K. recently concluded a new trade agreement, marking their first such deal since the introduction of new tariffs in early April.

Another notable development last week was the Federal Open Market Committee’s (FOMC) decision. The Federal Reserve kept its benchmark interest rate unchanged, as expected. However, the Fed signaled ongoing risks of higher inflation and unemployment, suggesting a cautious outlook for monetary policy adjustments in the near term.

The next Federal Open Market Committee (FOMC) meeting is scheduled for June 17–18, 2025.

Gold prices were volatile last week, initially rebounding to $3,333.86 per ounce on May 9 in response to ongoing economic uncertainty and the Federal Reserve’s cautious stance on inflation and labor market risks. However, after the announcement of a major US-China trade agreement that eased tariff tensions, investor sentiment shifted toward riskier assets, leading to a sharp decline in gold prices. By the end of the week, gold had dropped below $3,250 per ounce, losing more than 2% on the day as risk appetite increased and demand for safe-haven assets waned.

Overall, gold ended the week down about 2%, retreating from its recent record highs as optimism over global trade talks reduced safe-haven demand.

Earlier in the week, oil had been under pressure due to concerns about oversupply, as OPEC+ announced plans to accelerate production increases in May and June. Despite this, the positive sentiment from the trade breakthrough outweighed supply concerns, helping oil record its first weekly rise since mid-April.

If you found this poslpful, we encourage you to subscribe. Our content delivers high-quality macroeconomic and financial insights and education for anyone looking to enhance their understanding of the financial markets and the economy.

In our view, long-term success in financial markets relies on the knowledge you accumulate over time. Therefore, understanding how the global macroeconomic system operates is a crucial component of successful investing.

In addition to receiving our analysis and educational posts, paid subscribers also gain access to our tactical portfolio, which includes trade signals.